Cailian Press, July 8th (Editor Zhao Hao) – On Monday (July 7th), the U.S. stock market opened and closed lower, with all three major indexes recording their worst single-day performance since mid-June.

By the close of trading, the Dow Jones Industrial Average fell by 0.94%, to 44,406.36 points; the S&P 500 Index dropped by 0.79%, to 6,229.98 points; and the Nasdaq Composite Index declined by 0.92%, to 20,412.52 points.

During the session, news reports stated that Trump had posted a letter on social media platforms to Japanese Prime Minister Shinzo Abe and South Korean President Moon Jae-in, announcing that the United States would impose a 25% tariff on all imported products from Japan and South Korea starting August 1, 2025.

This announcement led to a decline in stocks of Japanese and South Korean companies listed in the U.S.: in terms of Japanese conglomerates, Toyota Motor Corporation saw its shares fall by 3.99%, Honda Motor Co. Ltd. by 3.88%; among South Korean conglomerates, LG Display fell by 8.03%, and South Korea’s SK Telecommunications fell by 7.72%.

At the close, Trump also announced that he would impose a 25% tariff on all Kazakhstani and Malaysian imports starting August 1, as well as a 30% tariff on all South African imports, and a 40% tariff on all Laotian and Myanmar imports.

According to news reports, the White House stated that there would be another 12 countries receiving letters regarding trade, which will be published on social media platforms. Trump will sign an executive order to delay the tariff negotiation deadline set for July until August 1.

City Index analyst Fawad Razaqzada commented, “Investors should be wary of the risks associated with headline news. The likelihood of reaching a deal at the last minute is high, but the possibility of escalating trade tensions again is also high.”

Montreal Bank Capital Markets reported: “As the trade war re-emerges as a market focus, U.S. Treasury yields surged significantly on Monday, aligning with the potential inflation rebound from increased tariffs.”

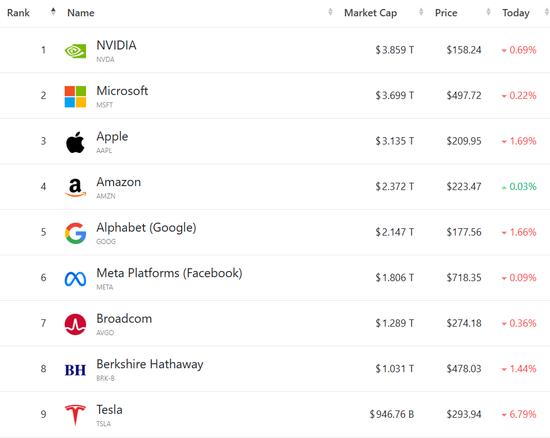

Major tech stocks mostly fell, ranked by market value: Nvidia dropped 0.69%, Microsoft fell 0.22%, Apple declined 1.69%, Amazon rose 0.03%, Google C plunged 1.66%, Meta fell 0.09%.

Tesla plummeted 6.79%, with the company’s total market value lost by more than $68 billion. Reports indicate that Tesla CEO Elon Musk announced the formation of the “American Party” on social media last weekend, causing investors to feel uneasy.

The Philadelphia Semiconductor Index fell 1.88%, with all 30 constituents declining. Arm Holdings dropped the most at 5.29%; Boson fell 0.36%, and Advanced Micro Devices fell the least at 0.14%.

Chinese concept stocks outperformed against the market, with the Nasdaq China Gold Dragon Index rising by 0.59%.

Popular Chinese concept stocks saw mixed results, Bilibili soared 7.66%, Blizzard Entertainment rose 5.31%, Baidu gained 3.98%, Li Auto climbed 3.06%, Tencent Music increased by 2.98%,好未来 rose 1.69%, and Pinduoduo rose 1.6%.

Xpeng Motors fell 4.99%, NIO fell 2.85%, Alibaba fell 2.24%, New Oriental Education Group fell 1.55%, and JD.com fell 0.16%.

[Apple Appeals EU Fine of €500 Million for Violating Digital Market Law]

Apple has appealed the €500 million fine imposed by the European Union for violating the Digital Markets Act.

[F1 Movie Sets Record for Box Office Revenue for Apple’s Cinema Chain Business, Yet Far From Profitability]

According to the latest data, Apple’s cinematic release “F1: Speed of Dreams” achieved a global box office of $293 million after last weekend.

Reportedly, the production cost of this movie is between $200 million and $300 million, with marketing expenses amounting to another $100 million. In addition to the producer Apple Inc., there are also licensing fees to be shared with Warner Bros. Discovery Inc. and theater chains.

[CoreWeave agrees to acquire Core Scientific in a full stock transaction]

The American artificial intelligence cloud service company CoreWeave announced on its official website that it has signed a final agreement to acquire the data center infrastructure provider Core Scientific in a full stock transaction. Each share of Core Scientific common stock can be exchanged for 0.1235 new CoreWeave A-class common shares, with the transaction value approaching $9 billion.

[Robinhood’s equity token faces EU regulatory scrutiny]

As Robinhood’s primary regulator in the European Union region, the Lithuanian Central Bank spokesperson stated on Monday through a declaration that they have contacted the involved brokerage and are awaiting clarification regarding the structure of OpenAI and SpaceX stock tokens, as well as related consumer communication. Only after assessing this information can the legality and compliance of these specific tools be determined.