Overnight, U.S. stocks saw a sudden surge during the session. Cryptocurrencies collectively soared, with Bitcoin momentarily breaking through $117,000.

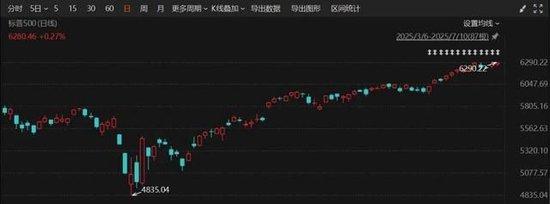

On Thursday, U.S. stocks rebounded during the session, closing up 0.09% for the Nasdaq and 0.27% for the S&P 500, both reaching new closing highs. The Dow Jones Industrial Average rose by 0.43%.

The performance of large technology stocks diverged, with Tesla closing up 4.7%, while Netflix fell more than 2%. Nvidia slightly closed higher, with its market value surpassing $4 trillion.

Investors’ focus has now shifted to the upcoming second-quarter earnings season next week. Delta Air Lines saw a significant increase in its stock price by 12%, boosted by its quarterly profit exceeding expectations and restoring its 2025 profit guidance.

Cryptocurrency stocks rose, with Coinbase surging over 4%.

Cryptocurrencies collectively advanced, with Bitcoin briefly soaring more than 5% and breaking through $117,000, setting a new historical high. Ethereum also rose by more than 6%.

In the past 24 hours, over 190,000 people experienced margin calls globally.

Popular Chinese concept stocks showed divergent performances, with the Nasdaq China Gold Dragon Index closing up 0.90%. Alibaba surged more than 2%, while NetEase fell more than 2%, and XPeng Motors and JD.com dropped more than 1%.

On the news front, President Trump reiterated his call on social media platform “Reality Social” for Federal Reserve Chairman Powell to cut interest rates again.

Federal Reserve Board member Waller stated that the Fed could consider cutting rates in July, stating his view on interest rates “isn’t political.”

San Francisco Fed President Dailey mentioned that there is a possibility of two rate cuts in 2025.