On July 11th, local time, as the U.S. stock market closed, Nvidia’s stock price rose by 0.50%, with its market value surpassing $4 trillion. Nvidia CEO Jensen Huang recently reduced his stake in the company by approximately 225,000 shares, valued at about $36.4 million, part of a stock sale plan he set up in March this year. Huang’s net worth has reached $144 billion, surpassing Warren Buffett and ranking him ninth globally. Many Wall Street analysts believe that Nvidia’s market value still has room to rise further.

As the U.S. stock market closed on July 11th, local time, Nvidia was trading at $164.92, up by 0.50%, with its latest market value reaching $4.02 trillion. During the session, Nvidia briefly surged over 2%, hitting a price of $167.89, setting a new historical high.

It is noteworthy that, as Nvidia’s total market value surpassed $4 trillion, Nvidia CEO Jensen Huang made another reduction in his company’s shares recently.

On July 11th, according to documents submitted to the U.S. Securities and Exchange Commission (SEC), Huang reduced his company’s stock holdings by approximately 225,000 shares,

valued at about $36.4 million (approximately 260 million RMB)

. This transaction was part of a stock sale plan he had set up earlier this year, which allowed him to sell up to 6 million shares by the end of the year.

Data previously released by the SEC showed that during two trading days on June 20th and 23rd, local time, Huang sold a total of 100,000 Nvidia shares.

The backdrop for these series of reductions in holdings is investors’ bets on Nvidia’s leading position in the field of artificial intelligence, pushing its stock price and Huang’s personal wealth to unprecedented levels.

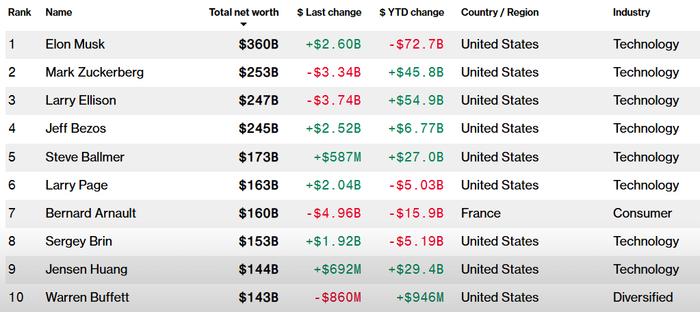

According to the Bloomberg Billionaires Index, Huang’s net worth has reached $144 billion, surpassing Warren Buffett ($143 billion), ranking him ninth globally.

According to Securities Times, the surge in Huang Rensheng’s wealth is attributed to Nvidia’s dominant position in the AI wave. As a global leader in GPU (Graphics Processing Unit) manufacturing, Nvidia’s hardware is widely used in AI training, inference, and the deployment of large language models, becoming the preferred infrastructure for tech giants such as OpenAI, Google, and Meta. Since the beginning of this year, Nvidia’s market value has continuously reached new highs, breaking through the $4 trillion mark on Wednesday last week, becoming the first company in history to reach this milestone, surpassing Microsoft and Apple. The stock continued to hold above $4 trillion on July 10th local time, solidifying its status as “the AI-first stock” in the global capital markets.

The success of Nvidia is not solely Huang Rensheng’s achievement. According to another document from the SEC, Brooke Seawell, a board member of the company and a venture partner at New Enterprise Associates, also reduced her stake in Nvidia recently, cashing out about $24 million. Seawell has been serving as a director of Nvidia since 1997, providing governance support for the company’s long-term development.

Photo source: Visual China – VCG31N2205305958

It is worth noting that Huang Rensheng’s series of sell-offs have raised concerns among some investors about the company’s governance and executive compensation structure. A governance expert, Nell Minow from ValueEdgeAdvisors, pointed out that frequent sell-offs by executives might signal a lack of confidence in the company’s long-term prospects. She believes that Nvidia should further disclose specific targets for linking executive compensation to performance, and optimize the CEO succession plan to enhance market confidence.

Moreover, the timing of Huang Rensheng’s sell-offs has been interpreted by some analysts as being “precisely timed.”

For example, after briefly reaching the top of “the world’s largest market capitalization” in June 2024, NVIDIA’s share reduction actions were highly coincident with the timing of its stock price decline. Despite the company’s emphasis on compliance with the 10b5-1 plan, the market remains concerned about its motivations.

Furthermore, as it achieved a $4 trillion market capitalization milestone, NVIDIA’s current market value is almost equivalent to the combined total of the 214 underperforming stocks in the S&P 500 Index.

Many Wall Street analysts believe that there is still room for further growth in NVIDIA’s market value.

In June this year, Barclays analysts, based on their optimistic view of the Blackwell chip launch, raised NVIDIA’s target price to $200; this would make NVIDIA’s market value reach $4.9 trillion.

At the same time, according to data from FactSet, Loop Capital analyst Ananda Baruah has already set NVIDIA’s highest target price for Wall Street to date: $250. If NVIDIA’s stock price reaches this target, its valuation would reach $6 trillion.

Daily Economic News combines Securities Times and market public information.

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Please verify before use. Risks associated with this action are assumed by the reader.