On July 15th, U.S. stock markets closed with mixed results, with the Nasdaq slightly rising and the Dow Jones Industrial Average and S&P 500 indexes falling. Nvidia’s stock price surged significantly, increasing its market value by $161.8 billion, and its founder announced that the H20 chip would be approved for sale in China, along with the launch of a new GPU. Popular Chinese concept stocks saw most of them rise. International oil prices fell, and cryptocurrencies collectively plummeted, with Bitcoin dropping more than 5% at one point. The U.S. June CPI year-over-year growth rate was 2.7%, exceeding expectations, but the market believes it has limited impact on Federal Reserve policy.

On July 15th, local time, U.S. stock indexes closed with mixed results, with the Nasdaq up by 0.18%, the Dow down by 0.98%, and the S&P 500 down by 0.4%.

Chip stocks rose, with Taiwan Semiconductor Manufacturing Company (TSMC) surging over 3%, and the Philadelphia Semiconductor Index up by 1.27%.

Nvidia soared 4.04%, closing at $170.7, with its latest market value reaching $4.17 trillion, an increase of $161.8 billion overnight (approximately 1160.5 billion yuan). According to news, on July 15th, during an interview with CCTV, Nvidia’s founder and CEO, Jense Hoang, announced two significant developments: first,

; second, Nvidia will launch the RTX Pro GPU. Hoang stated, “The Chinese market is vast, vibrant, and highly innovative, and it is also a gathering place for many AI researchers. Therefore, it is crucial for American companies to establish themselves in the Chinese market.”

Bank stocks mostly declined, with BlackRock and Wells Fargo falling by more than 5%, but Citigroup’s stock price rose by 3.7%, closing at the highest since 2008.

Popular Chinese concept stocks mostly rose, with the Nasdaq China Gold Dragon Index closing up by 2.77%. Huami Technology increased by 38.66%.

Baidu, Alibaba, and Bilibili all rose by more than 8%, while JD.com increased by more than 4%, and Pinduoduo and NetEase both rose by more than 2%.

The FTSE A50 futures index closed lower for the night session by 0.03%, at 13749 points.

International oil prices fell on the 15th. By the close of that day, the price of light crude oil futures for August delivery at the New York Mercantile Exchange dropped by $0.69 to $66.52 per barrel, a decrease of 0.69%; the price of September delivery Brent crude futures at the London Bullion Market also fell by $0.72 to $68.71 per barrel, a decrease of 0.72%.

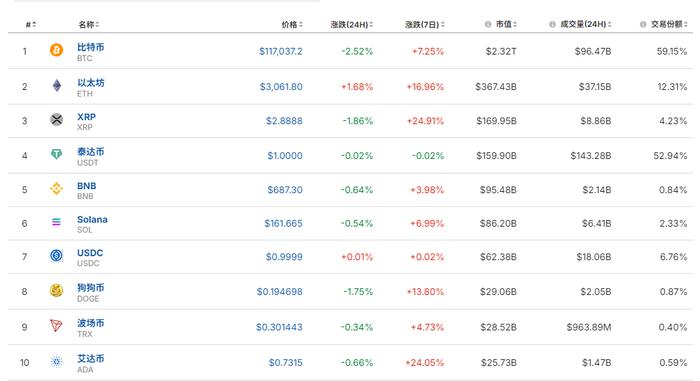

On July 15th, cryptocurrencies experienced a significant plunge, with Bitcoin’s intraday drop exceeding 5%, and Solana, Hedera, and Dogecoin dropping by more than 8% at one point.

As of July 16th, when this article was published, Bitcoin had fallen by 2.52%. According to data from Coinglass, over the past 24 hours,

the number of people who have defaulted on contracts across the cryptocurrency market has exceeded 130,000,

with the default amount reaching $493 million. Among them, long positions were defaulted on by $393 million, while short positions were defaulted on by nearly $100 million.

According to Securities Times, analysts pointed out that the sudden decline in cryptocurrencies mainly faced three risks: firstly, the recent surge in prices led some funds to cash out for profit; secondly, the release of the U.S. June CPI data caused investors to remain cautious because the data could affect the Federal Reserve’s attitude towards interest rate cuts and impact risk assets such as cryptocurrencies; thirdly, there were new uncertainties regarding tariffs, with the United States threatening to impose 100% tariffs on Russia, and secondary tariffs on countries purchasing Russian oil.

Stefan von Haenisch, the head of off-exchange trading at Bitgo Asia Pacific, said, “This is just a standard pullback after the market overheated. The next key support level for Bitcoin is $114,000, which triggered a large number of short positions before.”

On the evening of July 15th, Beijing time, the U.S. June CPI report was released.

The data showed that the U.S. June CPI year-over-year growth was 2.7%, exceeding expectations, previously estimated at 2.6%, and the previous value was 2%.

4%; June CPI month-on-month growth was 0.3%, market estimates were 0.3%, with the previous value being 0.1%.

In June, the core CPI of the United States, excluding food and energy prices, rose by 2.9% year-on-year, meeting expectations but higher than the previous value (2.8%). The core CPI month-on-month increase was 0.2%, lower than the expected 0.3%.

Despite the relatively moderate inflation in the U.S. in June, signs indicate that the impact of tariffs may begin to gradually emerge. In June, clothing prices rose by 0.4% month-on-month, and footwear prices increased by 0.7% after a few months of decline. Furniture and bedding prices also climbed by 0.4%, reversing the 0.8% drop in May. This may suggest that cost pressures related to tariffs are beginning to be transmitted to consumers.

According to Shanghai Securities News, Nick Timiraos, known as the “Fed whisperer,” stated that the June CPI data has limited impact on Fed policy, and further rate cuts should be cautiously watched.

Nick said the CPI report is somewhat subjective, slightly below some forecasts, but most forecasters expect trade policies to have a more significant impact on inflation in July and August, while commodity prices in June remain firmer. “If you think the worst period for price increases caused by trade policies is still behind us, then this report will not change your fundamental view,” he said.

After the data was released, the market continued to favor a Fed rate cut starting in September. The “Fed Watch” tool from ICE Futures & Options UK showed that, as of the time of publication, the probability of the Fed keeping interest rates unchanged in July was 97.4%, and the probability of the Fed taking rate cuts in September exceeded 60%.

Neil Dutta, the head of macroeconomic research at Renaissance Macro Research, stated that he has observed signs of economic weakness in this report. This is because although some commodity prices are rising, the sluggishness in service prices indicates vulnerability among consumers.

Daily Economic Comprehensive Securities Times, Shanghai Securities News, Market Open Information

Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Please verify before use. Operations based on this information assume full responsibility for risks.