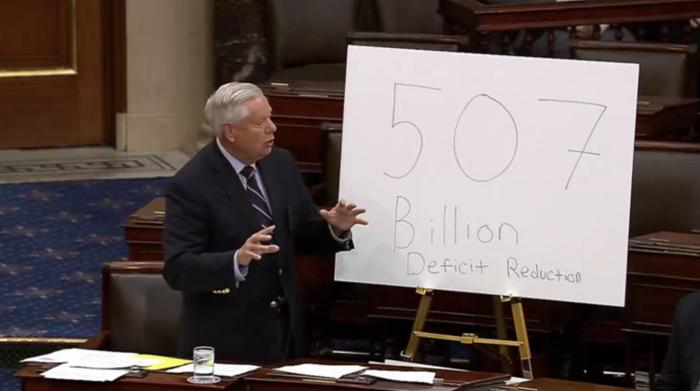

△Lindsey Graham Takes the Stage with a Hand-Drawn Board

On the afternoon of June 29th, local time, Lindsey Graham (a Republican from South Carolina), Chairman of the Senate Budget Committee, took the stage with a hand-drawn board to present a new assessment by the Congressional Budget Office (CBO) claiming that under the “current policy baseline,” the Republican version of the “big and beautiful” bill would save approximately $500 billion in fiscal spending over the next decade.

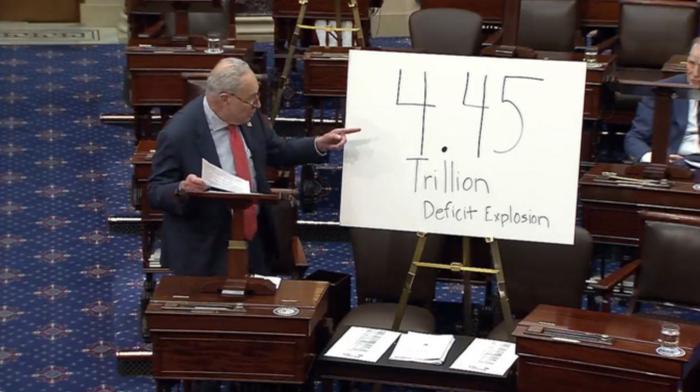

△Chuck Schumer Takes the Stage with a Homemade Paperboard

Hours later, Chuck Schumer (a Democrat from New York), the minority leader of the Senate, also took the stage with a homemade paperboard, responding that the bill would actually increase federal deficits by $4.45 trillion. This “wallboard battle” is not only seen as a mockery of an impromptu performance but also highlights the fundamental disagreement between the two parties on budget pricing methods. The Republican Party’s use of the “current policy baseline” for cost assessment assumes that the Trump tax cuts, which were set to expire at the end of 2025, would be extended indefinitely. According to this approach, CBO’s assessment shows that the bill would “save money.”

Schumer, however, referred to another assumption: not only would the existing tax cuts be extended, but additional tax cuts would also be added and permanently retained, thus expectedly increasing the federal deficit by $4.45 trillion. CBO’s previous assessment under the traditional baseline (considering the end of tax reductions) estimated that the bill would add $3.25 trillion in deficits.

The bill is merely “fake savings, real bankruptcy”. The ongoing offensive and defensive strategies around the bill’s costs, fiscal discipline, and legality of procedures are still ongoing.

What is the “Big and Beautiful” Bill?

The so-called “Big and Beautiful” bill is a simplified term used by President Donald Trump for his large-scale tax and expenditure legislation. It is seen as an extension and upgrade of Trump’s first term tax cuts policy, as well as a reduction and adjustment of policies such as Biden’s “Green New Deal”, welfare, and expenditures. The bill plans to reduce taxes by $4 trillion over the next decade and cut at least $1.5 trillion in spending.

The bill introduces several tax relief measures, including exemptions for overtime pay and tips, as well as significantly increasing the exemption for estate and gift taxes, with further adjustments based on inflation indexes to come.

On June 29th, local time, the US Senate completed reading the 940-page “Big and Beautiful” bill and began formal debate on it. After the debate concluded, the Senate will begin voting on the bill. (Liu Xiaoqian)