Paulo Bin, an economics professor at the University of Siena in Italy, wrote an article for China Daily on July 29th, using the example of US-China-European wine trade to argue that imposing tariffs would only backfire and fail to protect domestic industries. In light of this, policymakers should adapt to the current trends in trade development.

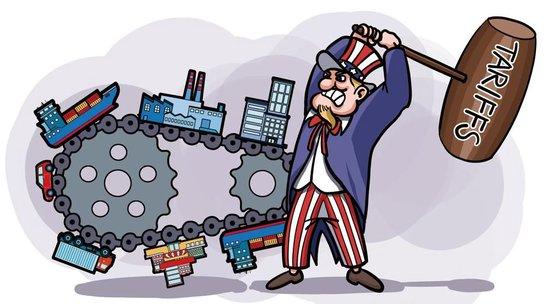

Cartoonist: China Daily, Jin Ding

Imposing Tariffs Would Backfire

The article analyzes that, similar to an ecosystem, international trade is a complex system composed of many interconnected parts, where even minor changes can have a significant impact. Many people view tariffs as a simple regulatory tool, believing that imposing tariffs on imported goods could protect domestic industries. However, trade interactions are intricate, involving not only one-to-one trade between countries but also networks formed by decisions made by businesses and governments. These choices interact with each other, changing one part can lead to changes in the entire system.

Given the close connections of today’s world, slight adjustments in a country’s tariff policies could trigger a chain reaction, ultimately harming the interests of those it was intended to benefit. This has already happened or is about to happen for many American companies and their customers. This case clearly demonstrates that some policies can have unintended consequences.

The author further elaborates on this point by citing three participants in the wine trade: the European Union, which produces wine, the United States, which both produces and consumes wine, and China, which increasingly becomes a major consumer of wine.

Under normal circumstances of smooth international trade, the EU produces wine at lower costs and sells it to the United States, while the United States also sells wine to China. Everyone focuses on their areas of expertise. Against this backdrop, wine prices are fair, and everyone achieves mutual benefits, achieving a balance of trade.

However, what happens next if the U.S. government imposes tariffs on imported wines from Europe to aid domestic wine producers? As expected, the volume of European wine exports to the U.S. will decrease. This leads to European producers being shut out of the American market and starting to sell more wine to China at lower prices, offering high-quality products. Consequently, U.S. wine exporters face fiercer competition in China, even losing some customers.

In the U.S., due to fewer competitors, both domestically produced and imported wines are priced up. However, this does not bring any significant benefits to U.S. producers; they lose a significant opportunity to enter the Chinese market, and the domestic market’s demand is not sufficient to compensate for this loss. Moreover, as European wine gradually exits the U.S. market, the revenue generated by U.S. tariffs will inevitably decline. In other words, imposing tariffs on one country ultimately leads to its own downfall, which contradicts its initial intention.

Decision-makers should seize the right moment and act accordingly.

The article further points out that in real life, trade involves thousands of interconnected products. If farmers produce more wine, they might reduce the production of other products. If consumers increase their expenditure on wine, they might cut back on other expenses. Policymakers should take these risks seriously.

In a recent study, the author established a model to examine how countries respond to tariffs. In this simplified model, each company in a country only sells one product and chooses the sales location based on profit margins. Within these trade flow networks, every transaction relies on other trade cooperations. If a particular trade is disrupted by a punitive tariff, other trade activities may also be interrupted or altered. Thus, the entire network needs to be restructured.

Even the slightest adjustments to tariff policies can trigger significant changes. If a trade route becomes unprofitable, producers will seek new customers, and consumers will have to pay for higher prices. At the same time, other competitors will also enter the new market. Therefore, if the government imposes tariffs to help local businesses, it may ultimately harm their interests.

Given this, trade policy is quite tricky; it should not be treated as a simple arithmetic problem but rather as operating on a complex system. If policies aimed at benefiting businesses end up leading to losses, decision-makers should reconsider these policies. Sometimes, promoting trade freedom flows can achieve better results than interfering with trade exchanges.

The article concludes by emphasizing that when discussing tariff issues, it is crucial to remember that trade operates on complex rules. It is like brewing fine wine; numerous factors must be balanced appropriately, and a single mistake could ruin the entire process.