Cailian Press, August 15th (Editor: Shi Zhengcheng)

Last night and this morning, the momentum of the U.S. stock market hitting new highs collided with reality—the inflationary wave triggered by tariffs has finally emerged. The three major U.S. stock indexes were in turmoil throughout the day, eventually closing almost flat.

By the close of trading, the S&P 500 index rose by 0.03%, at 6468.54 points; the Nasdaq Composite index fell by 0.01%, at 21710.67 points; and the Dow Jones Industrial Average index dropped by 0.02%, at 44911.26 points. Logically, the S&P 500 index once again set a new “close-of-day historical high,” but today clearly was not such a joyful scene.

The U.S. industrial producer price index for July saw a significant increase of 0.9% month-on-month, marking the largest gain since the peak of inflation in June 2022, with market expectations only at 0.2%. The year-over-year growth rate also reached 3.3%, significantly higher than the expected value of 2.5%.

Matthew Martin, an economist at Oxford Economics, stated that the PPI report likely indicates what the future will bring to American consumers.

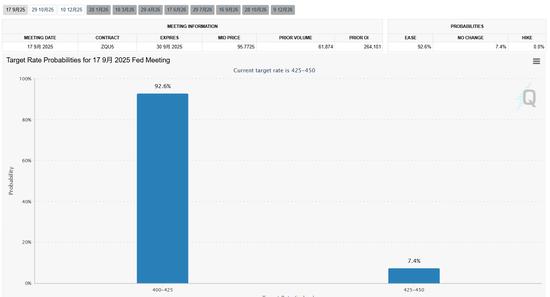

This has also let the market that was speculating on faster Fed rate cuts yesterday lose its steam. Traders who fully predicted a 100% rate cut in September now have the probability of cutting by 25 basis points back to 92%.

Clark Geranen, Chief Market Strategist at CalBay Investments, interpreted it as follows:

A PPI above expectations and a relatively weak CPI indicate that American companies are bearing most of the tariff costs, rather than passing them on to consumers. However, companies may soon start changing their practices and pass these costs onto consumers.

He also mentioned that the importance of Powell’s speech at Jackson Hole is because the stock market has warmed up in recent weeks due to anticipation of a rate cut in September, with investors eager for further validation of this expectation.

Some market participants mentioned that the Thursday’s lack of significant decline was partly due to expectations for a meeting between U.S. and Russian leaders on Friday. However, both governments have been making public statements in recent days, urging the public to lower their expectations for the outcome of the talks.

Tech giants were generally underperforming, but they also contributed to stabilizing the broader market. By the close of trading, Apple fell by 0.24%, Microsoft rose by 0.36%, Amazon, which is involved in an “order-food war,” increased by 2.86%, Nvidia rose by 0.24%, Google-A gained by 0.49%, Tesla declined by 1.12%, and Meta rose by 0.26%.

Due to rumors of “U.S. government discussions about investing,” Intel saw its stock price increase by 7.38%.

On Thursday, Chinese concept stocks collectively entered a state of adjustment, with the Nasdaq China Gold Dragon Index closing down by 2.13%.

By the close of trading, Alibaba fell by 3.61%, Baidu by 2.57%, Pinduoduo by 1.62%, Bilibili by 2.26%, NIO by 3.68%, NetEase by 3.88%, Futian Holdings by 0.98%, Li Auto by 4.62%, XPeng Motors by 3.97%.

After releasing its financial report on Thursday, on-shelf delivery company JD.com closed down by 2.86%, Weibo surged by 11.28%, Youdao by 9.91%, Xunfei by 12.72%.

【Market News: The Trump administration is discussing investing in Intel】

Before the close of trading on Thursday, there was suddenly news that the Trump administration is in negotiations with Intel Corporation, possibly supporting its efforts to expand domestic semiconductor manufacturing through investment. Insiders said the plan originated from a meeting this week between Trump and Intel CEO Chen Liwu, with plans including government funding for equity purchases, details still to be finalized. Influenced by this news, Intel surged at the end of trading, ultimately closing up by 7.38%.

Intel responded to the news by saying, “The company looks forward to continuing its cooperation with the Trump administration on these shared priorities, but we will not comment on rumors or speculation.”

[Berkshire Hathaway Acquires $1.5 Billion in Healthco]

In the 13F filing released early Friday morning in Beijing time, Berkshire Hathaway disclosed that it had acquired 5.039 million shares of UnitedHealthcare, an American health insurance company, during the second quarter, bringing the total value at the end of the quarter to $1.57 billion. In addition, Berkshire Hathaway also opened positions in steel manufacturer Nucor, outdoor advertising company Lamar Advertising, and security company Allegion in the second quarter. It also repurchased Class A shares of Lennar and DR Horton.

As a result, UnitedHealthcare’s stock price increased by 9% after the market closed, and Nucor also jumped nearly 6%.

[Gilead Sciences Raises Prices for Weight Loss Drugs by Up to 170% in the UK Market]

The American pharmaceutical giant GlaxoSmithKline announced that starting from September, it would raise its weight loss drug Mounjaro’s prices by up to 170% in the UK market in response to Trump’s complaints about “foreign cartel” causing high drug prices in the US.

[Apple Watch Allows Redesigned Blood Oxygen Monitoring Function in the US]

On Thursday, Apple Inc. announced that it would launch a redesigned blood oxygen monitoring function for Apple Watch users in the US through software updates for iPhone and Apple Watch later that day. Notably, the sensor data for the blood oxygen app on the Apple Watch will be measured and calculated by the paired iPhone, and the results can be viewed in the “Breath” section of the Health App.

[Applied Materials Falls Over 13% After-Hours]

Semiconductor equipment giant Applied Materials saw its stock price plummet more than 13% after the market closed on Thursday.

The company’s revenue and profit guidance for the current quarter fell short of market expectations. CEO Gary Dickerson stated that the current macroeconomic and policy environment “increases uncertainty and reduces visibility.”

Tapestry, the parent company of Coach, plummeted by 15.71% on Thursday. Chief Financial Officer Scott Ro said that the impact of U.S. tariffs would bring an additional cost of about $160 million for this fiscal year. Meanwhile, despite the strong performance of its Coach brand, Kate Spade’s poor performance led to a value reduction of $855 million for the company.

MIAX, operator of nine securities and derivative exchanges, saw its stock price increase by 33% on its first day of trading on the New York Stock Exchange. The group holds a 16% market share in the U.S. options market.