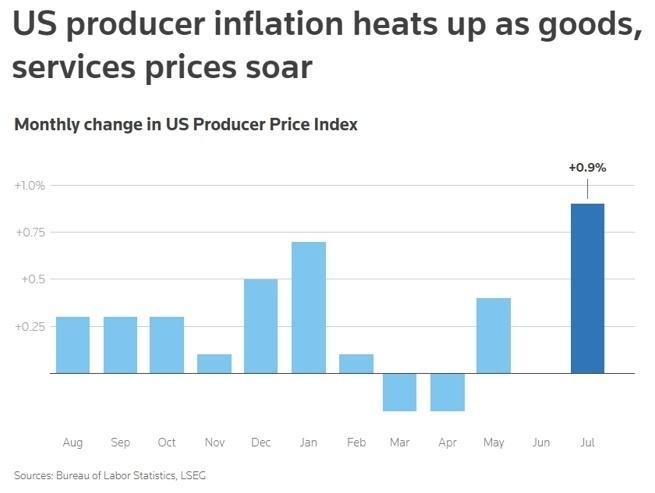

The recently released data from the US Department of Labor shows that the Producer Price Index (PPI) in July rose significantly, exceeding market expectations, indicating that the upstream of the US industry chain is facing a new round of inflationary pressure.

US media outlets believe that the cost pressure from tariffs will be passed down to downstream businesses, and that US merchants who have been bearing the cost of tariffs are struggling.

Some experts also claim that the United States will definitely experience an economic recession this year, and small and medium-sized enterprises may face a wave of closures during this period.

It is only a matter of time for US merchants to pass on the cost of tariffs to consumers. PPI is an important indicator that reflects the trend and magnitude of price changes in the production field and monitors economic performance. If PPI continues to rise, it may lead to expectations of interest rate increases and bond price declines; otherwise, it may push for interest rate reductions. In addition, a sustained increase in PPI will drive up raw material prices, subsequently leading to higher costs of related goods and ultimately affecting consumer prices.

The latest data from the US Department of Labor shows that the US PPI rose by 0.9% in July, which was significantly higher than the zero growth in June and the market expectation of 0.2%. It was the largest increase since June 2022; the year-on-year increase was 3.3%, which was significantly higher than 2.3% in June and the market expectation of 2.6%, reaching the highest level since February this year.

The data from the US Department of Labor also indicates that the rise in PPI in July was mainly driven by the service sector. The Producer Price Index for services rose by 1.1% for the month, which was the largest increase since March 2022.

Excluding volatile food and energy, the core PPI also rose by 0.9% for the month and by 3.7% year-on-year, which was significantly higher than the previous month’s 2.6% year-on-year growth.

After the release of the data, the US stock market weakened, while the US dollar and long-term bond yields rose.

Analysts believe that the data released on that day shows that US companies are facing cost escalation pressure and may further pass it down to downstream sectors. Brian White, an economist at Boston College, pointed out that considering PPI covers domestic goods and services output without imports, the potential impact on consumer price inflation may be underestimated.

Earlier this week, the US Department of Labor released its Consumer Price Index report, which showed that the Consumer Price Index (CPI) rose by 2.7% in July, which was unchanged from June. The core Consumer Price Index increased by 3.1%, higher than 2.9% in June.

Both data are higher than the Fed’s 2% target.

Screenshot from The Guardian

RSM, an accounting and consulting firm, Chief Economist Joe Brusuelas analyzed that this week’s data completely destroyed the argument that “foreigners pay tariff costs.”

“The CPI data in July has given us a new understanding of the long-term inflation forecast. The data released this week shows that the argument that foreigners pay tariff costs has been destroyed. If they were to pay the tariff costs, the producer price index would not rise but would fall. This also tells us that the profit margins of US companies will become increasingly lower in the future. This data from this week is not beneficial for the interest rate cut in September, which is far lower than the 50 basis points cut some people are planning.”

In the view of economists, it is only a matter of time for US businesses to pass on tariff costs to consumers. The surge in US PPI in July indicates that inflation is spreading throughout the economy, although US consumers are not yet feeling it.

“Retailers will face massive bankruptcies.”

US President Trump recently “blasted” Goldman Sachs CEO David Solomon on social media, saying he should “find a new economist” or “focus on being a DJ rather than running a large financial institution.” Solomon used to work as a DJ at parties and music festivals.

Screenshot from Fortune magazine website

The fuse for Trump’s anger is a report released by Goldman Sachs recently.

Jane Hozus, the chief economist at Goldman Sachs, estimated in the report on who bears the cost of US tariffs that as of June, US companies bore 64% of the tariff costs, consumers bore 22% of the tariffs, and foreign exporters bore 14% of the tariffs by lowering their export prices.

Goldman Sachs warned that if the US government continues to impose tariffs, by October, US consumers will bear 67% of the tariff costs, foreign companies will bear 25% of the tariff costs, and US companies will bear 8% of the tariff costs.

Screenshot from CNBC

After the White House expressed its “anger,” Goldman Sachs chose to “confront it.”

David Merlick, an economist at Goldman Sachs, still stood by his prediction in an interview that tariff costs will begin to hit US consumers’ wallets hard. “By fall, we estimate that consumers will bear about two-thirds of the cost.”

Screenshot from a report by CNBC (Consumer News and Business Channel in the United States)

Goldman Sachs is not the only research institution that believes tariffs will push up inflation in the United States. In a report, Michael Feroli, the chief U.S. economist at JPMorgan Chase, stated that tariffs could cause the U.S. GDP to decline by 1% and the inflation rate to rise by 1% to 1.5%. Given that the tariff increases this year far exceed any increase since the post-World War II era, there is considerable uncertainty about how much they will pass through to consumer prices.

Michael Feroli (image from reference materials)

格斯·福彻,国家公司首席经济学家也认同这一观点,认为关税将导致美国未来几个月通胀上升。福彻称,随着7月核心CPI的回升,以及企业将更高的关税成本转嫁给客户,未来几个月核心PCE通胀将进一步偏离美联储的目标。格斯·福彻(资料图)

Under the U.S. government’s tariff policy, small and medium-sized businesses in the United States, which have weak anti-risk capabilities, are the first to bear the brunt. According to Torsten Slok, the chief economist at Apollo Global Management, if the U.S. government does not change its current tariff policy, there is a 90% likelihood that the U.S. economy will shrink for two consecutive quarters, with a projected GDP decline of 4%. The United States will definitely fall into an economic recession this year, and small and medium-sized enterprises may face a wave of closures during this period.

“Large companies can bear additional costs, but small and medium-sized businesses do not have working capital. So think about toy sellers in Nebraska, men’s clothing stores in Wyoming, and ski equipment salesmen in Colorado who simply do not have money to pay the additional 145% tariff. If this situation persists, retailers will face massive bankruptcies.”