Cailian Press, July 3rd report (Edited by Xia Junxiong)

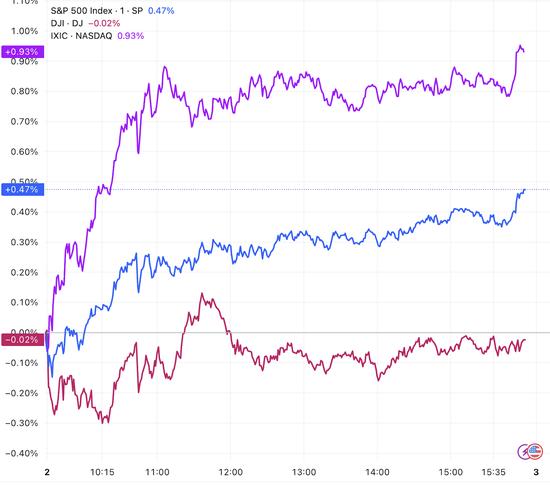

On Wednesday Eastern Time, the three major indexes only saw a slight decline in the Dow Jones Industrial Average, while both the S&P 500 and Nasdaq index broke new historical closing highs.

By the close of trading, the Dow Jones Industrial Average fell by 0.02%, at 44,484.42 points; the S&P 500 index rose by 0.47%, at 6,227.42 points; the Nasdaq Composite Index increased by 0.94%, at 20,393.13 points.

President Donald Trump announced on his own social media platform Truth Social on Wednesday that the United States had reached a trade agreement with Vietnam, imposing a 20% tariff on goods imported from Vietnam.

Trump also stated that for so-called “forwarding trade” (i.e., goods originally produced in other countries but transported through Vietnam), Vietnamese goods would face an even higher 40% tariff.

The trade agreement between the US and Vietnam has somewhat boosted market sentiment. However, earlier released ADP employment data showed that the private sector in the US reduced its job count by 33,000 jobs in June, marking the first monthly decrease since March 2023. Economists had previously expected an increase of 100,000 jobs.

Ross Mayfield, a Baird investment strategist, commented: “In fact, we have seen weak labor markets for several months now. I’ve been wondering if it’s only when employment data shows negative growth that the Federal Reserve will focus more on the labor market rather than solely on inflation. This data might just catch their attention.”

However, it should be noted that the ADP employment data has limited accuracy in predicting government nonfarm payroll reports, which are set to be released on Thursday. Economists expect nonfarm payroll growth in June to be 110,000.

Analysts pointed out that the nonfarm data also fell short of expectations, and the Federal Reserve may discuss interest rate cuts at its meeting later this month.

Meanwhile, the market is also paying attention to Trump’s tax and spending bill. The bill was narrowly passed by the Senate on Tuesday and has now been sent back to the House of Representatives, but some Republican lawmakers remain opposed.

Oracle surged 5%, with reports that the company is expanding its cooperation with OpenAI to establish more data centers in the United States.

Tesla rose 5%, with its Q2 delivery figures exceeding market pessimistic forecasts.

Nike increased by 4%, as the company has a foundry in Vietnam.

Most major tech stocks saw gains, with Apple up 2.22%, Microsoft down 0.20%, Nvidia up 2.58%, Google up 1.59%, Amazon down 0.24%, Meta down 0.79%, and Tesla up 4.97%.

Popular Chinese concept stocks varied in performance, with the Nasdaq China Gold Dragon Index up 0.06%, Alibaba down 2.86%, JD.com down 0.70%, Pinduoduo down 1.44%, NIO down 0.85%, XPeng Motors up 0.60%, Li Auto down 2.57%, Bilibili down 2.34%, Baidu up 0.46%, NetEase down 1.32%, Tencent Music down 0.36%.

【OpenAI and Oracle reportedly ramp up “Stargate” project, establishing more data centers in the US】

According to sources, artificial intelligence (AI) research firm OpenAI has agreed to lease substantial computing power from Oracle’s data centers as part of the “Stargate” initiative.

Sources say OpenAI will lease an additional total of about 4.5 gigawatts of data center electricity from Oracle, marking an unprecedented scale of energy consumption, equivalent to the capacity needed to power millions of American households. One gigawatt is roughly equal to the power generation capacity of a nuclear reactor, sufficient for approximately 750,000 households.

To meet the additional computing power needs of OpenAI, Oracle plans to build new data centers across multiple states in the United States with partners.

According to insiders, the selected locations include Texas, Michigan, Wisconsin, and Wyoming, while plans are also underway to expand the power capacity of the Abyssinia data center from its current 1.2 gigawatts to approximately 2 gigawatts. OpenAI is also considering other locations such as New Mexico, Georgia, Ohio, and Pennsylvania.

Boosted by this news, Oracle closed up 5% on Wednesday. Since the beginning of the year, the stock has risen nearly 38%, primarily driven by its cloud business growth.

【Tesla Delivers Over 384,000 New Cars in Q2】

On July 2nd, Tesla announced that it produced 410,244 vehicles in the second quarter of 2025, with deliveries amounting to 384,122 units. Among these, the Model 3/Y model accounted for a total of 373,728 deliveries. Additionally, Tesla’s energy storage products saw an installation volume of 9.6 gigawatt-hours (GWh) in the second quarter.

【Alibaba: Remains With a $19.3 Billion Repurchase Cap Under Share Buyback Plan】

On the evening of July 2nd, Alibaba announced in Hong Kong Stock Exchange that, during the fiscal period ending June 30, 2025, the company repurchased a total of 56 million shares at a price of $805 million, equivalent to 7 million US depositary shares. These repurchases were conducted in accordance with the company’s share buyback plan in the U.S. As of June 30, 2025, Alibaba still has a repurchase cap of $19.3 billion under the authorization of its board of directors, valid until March 2027.

【WeRide: W5 Unmanned Logistics Vehicle Approved for Road Testing in Guangzhou Huangpu District】

On July 2nd, WeRide announced that on June 27th, the company had obtained the first batch of unmanned vehicle road testing licenses in Huangpu District, Guangzhou. Its unmanned logistics vehicle, Robovan W5 (hereinafter referred to as “W5 Unmanned Logistics Vehicle”), has commenced road testing across the entirety of Huangpu District. Additionally, WeRide’s W5 Unmanned Logistics Vehicle was awarded the “Sui S·F0001 Trial” license plate, making it the first unmanned logistics vehicle approved for operation in Huangpu District, Guangzhou.