Following multiple requests for the Federal Reserve to cut interest rates and subsequent threats to replace current Fed Chairman Jerome Powell, President Donald Trump once again targeted Powell and demanded Congress investigate him. On February 2nd, Trump posted an article on social media stating that Powell should be immediately removed from office.

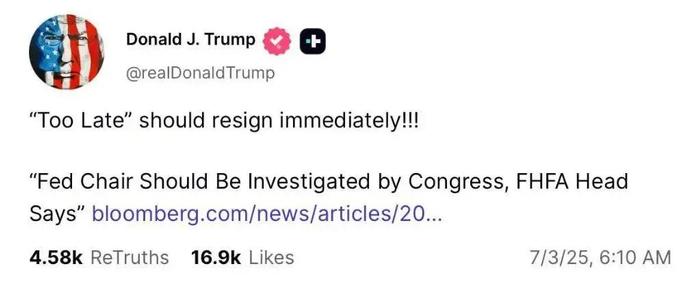

On the same day, Trump reposted an article about Powell’s potential investigation and commented, “‘Too late (Mr.)’ should be immediately removed!!!”

According to multiple media reports, the Trump administration requested Congress investigate Powell on the grounds of “political bias” and “false statements made in Congress,” accusing Powell of leading a major violation in the Fed headquarters renovation project. They claimed Powell deliberately concealed facts and adopted a negative attitude during congressional inquiries, warranting his removal and accountability.

Reports indicated that the renovation of the Fed headquarters cost $2.5 billion, exceeding the budget by approximately 32%, which was criticized as “luxury decor.” In response to inquiries, Powell admitted to exceeding the budget for the renovation project but denied the “luxury decor” accusation, stating the renovation was necessary for “safety and modernization.”

On January 1st, Trump mentioned having “two to three candidates” available to replace Powell. The day before, Trump posted a chart on social media claiming that the United States is one of the world’s central banks with the highest key interest rate levels. He criticized Powell for allowing trillions of dollars to be lost in the U.S., saying the Fed “should feel ashamed for allowing this situation to occur in the United States.”

Previously, when Trump pressured the Fed to cut interest rates, he referred to Powell as “Too late Mr.” and said Powell “wouldn’t move slowly on interest rate cuts if it wasn’t for helping Biden and others campaign.”

Powell: Not Considering Political Factors

Despite Trump repeatedly urging the Federal Reserve to cut interest rates, the Federal Open Market Committee decided on June 18th to maintain the federal funds rate target range unchanged at its monetary policy meeting. This marks the fourth consecutive decision to keep rates unchanged since January this year.

On July 1st, Powell reiterated at the European Central Bank’s Central Bank Forum in Sintra, Portugal, that the Federal Reserve remains patient and waits for further rate cuts but does not rule out the possibility of a rate cut at this month’s meeting, stating that everything depends on the data to be released soon.

“We are striving for macroeconomic stability,” Powell stated at the forum. “To achieve this successfully, we need to do so in a completely non-political manner, which means we cannot favor any side.”

For months, Trump has criticized Powell multiple times for the Fed’s failure to cut rates. He mentioned that the federal government is paying massive interest due to the Fed’s failure to lower interest rates. Powell said during a congressional hearing on June 24th, “We do not consider political factors when setting interest rates.”

Experts: Continued Pressure May Lead to Financial Market Disorder

According to a report by The Financial Times website, recent comments from Trump about Powell have “further heightened market concerns about the Fed’s independence,” and any attempt to remove Powell or pressure the Fed on its monetary policy could lead to further turmoil in the U.S. markets.

The President typically announces the next nominee for the position of Chairperson of the Federal Reserve only in the last few months of his current term. Under U.S. law, although the Chairperson of the Federal Reserve is nominated by the President, the Fed is not directly accountable to the President and enjoys high independence.

Powell’s term should end in May 2026. He stated that Trump lacks legal authority to dismiss him as President, and he will continue working until the end of his term.

The Wall Street Journal recently reported that Trump is considering Kevin Warsh, a former Federal Reserve Board member, and Kevin Hassett, the head of the White House National Economic Council, as potential successors to Powell. Other potential candidates include Scott Bessent, the Treasury Secretary, World Bank President David Malpass, and Federal Reserve Board member Christopher Waller. The report mentioned that Trump had considered selecting and announcing a successor as early as September or October.

Experts have stated that if Trump continues to pressure Powell, it could lead to financial market instability, weaken the dollar, and push up long-term interest rates.