Cailian Press, July 9th (Editor Zhao Hao) – On Tuesday (July 8th), the U.S. stock market experienced mixed results, with the three major indexes closing at varying levels of gains and losses.

By the close of trading, the Dow Jones Industrial Average fell by 0.37%, ending at 44,240.76 points; the S&P 500 Index decreased by 0.07%, finishing at 6,225.52 points; the Nasdaq Composite Index rose by 0.03%, reaching 20,418.46 points.

According to news reports, the day before, the United States announced that starting from August 1st, it would impose tariffs on imported products from 14 countries including Japan and South Korea, ranging from 25% to 40%. Additionally, it decided to postpone the expiration date for the “countervailing duty” until August 1st.

In response, Pamela Koch-Hamilton, Executive Director of the International Trade Centre, a joint institution of the United Nations and the World Trade Organization, stated that Trump’s move to extend the negotiation period for tariffs actually further increased uncertainty and instability.

During trading, according to news reports, Trump mentioned during a cabinet meeting, “We will soon announce some important measures in the medical field.” He added, “We will give related companies about one year to one and a half years to adjust, after which they will face tariffs.”

He continued, “If they must import drugs and other related products into the country, the tariffs will be as high as 200%.” Furthermore, Trump also mentioned considering imposing an additional tax of 50% on copper imported into the United States.

Affected by this news, New York futures copper saw its intraday gain expand to 17%, peaking at $5.8955 per pound. The copper concept stocks overall strengthened, with MacMullan Copper & Gold rising by 2.53%, and Taseko Mines increasing by 4.26%.

Trump’s signals on trade have left traders struggling to keep up, with investors awaiting further clarity. Many anticipate that the final tariff rates imposed by the United States will not be as high as Trump threatened.

Morgan Stanley strategists wrote in their report that investors should re-hedge before the tariff deadline on August 1, given the US stock index is nearing its historical high and geopolitical risk premiums have largely dissipated.

Piper Sandler analysts stated, “Even as trade concerns heat up again, the stock market outlook remains bullish. Although the market may face some pressure in the short term, investors’ attention to tariff news is gradually declining.”

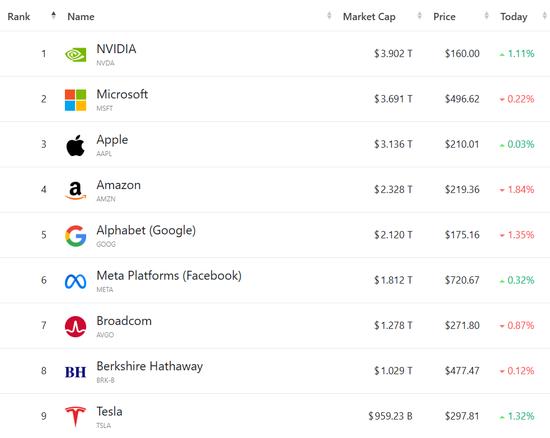

Nvidia surged 1.11% to $160 per share, closing at a new historical high, with the company’s total market value exceeding $3.9 trillion.

Other major tech stocks saw mixed results, ranked by market capitalization: Microsoft fell 0.22%, Apple rose 0.03%, Amazon dropped 1.84%, Google C fell 1.35%, Meta Platforms increased 0.32%, Boson declined 0.87%, Tesla rose 1.32%.

The Philadelphia Semiconductor Index rose 1.8%, with only three out of 30 constituents falling. Intel soared 7.23%, the largest gain; GlobalFoundries rose 6.96%, Analog Devices Group gained 5.5%, Micron Technology climbed 3.75%.

Chinese concept stocks overall strengthened, with the Nasdaq China Gold Dragon Index rising 0.71%, outperforming the three major US stock indexes.

Popular Chinese concept stocks mostly closed higher, with Fugu Holdings increasing 6.01%, NIO rising 2.64%, Good Futures climbing 2.35%, JD.com up 2.12%, New Oriental Education & Technology up 2.07%, Alibaba up 1.62%, Tencent Music up 1.25%, Pinduoduo up 1.01%, Li Auto up 0.9%, Baidu up 0.55%, Xiaopeng Motors up 0.11%.

[Trump Threatens High Tariffs on Drugs]

According to reports, President Trump announced during a cabinet meeting on the 8th local time that “we will soon announce some important measures in the pharmaceutical sector.”

Trump stated, “We will give the relevant companies about a year to a year and a half to adjust, after which they will face tariffs.” He added, “If they must import pharmaceuticals and other related products into the country, the tariffs will be as high as 200%.”

[Trump: Hopes to Establish an Air Traffic Management Modernization Company]

Trump expressed his desire to establish a company specifically responsible for the modernization of air traffic management. Remington and IBM will participate in the bidding process, with the system expected to take two years to complete. Trump mentioned that contracts could be signed within the coming months. Previously, due to frequent aviation accidents, the head of the Federal Aviation Administration’s air traffic organization resigned in April this year.

[United Airlines Says Flights to Tel Aviv, Israel, Will Resume This Month]

United Airlines announced that it will resume flights to Tel Aviv, Israel, on July 21st. On June 19th, local time, due to escalating conflicts between Israel and Iran, United Airlines and American Airlines suspended flights to the Middle East.

[Meta reportedly acquired approximately 3% stake in EssilorLuxottica SA]

It is reported that Meta Platforms has acquired approximately 3% of the shares of EssilorLuxottica SA, the world’s largest eyewear manufacturer, for approximately $3.5 billion. Analysts believe that if this investment is true, it indicates Meta’s increased investment in the rapidly growing smart glasses market.

[Ten-League International Lists on U.S. Stock Market, First Day Falls by 6.75%]

Singapore’s heavy equipment and engineering consulting service provider Ten-League International listed on the U.S. stock market on Tuesday, closing down 6.75% at $3.73, below its initial public offering price of $4.

Ten-League International primarily engages in the sales of heavy equipment and its components, as well as the leasing of heavy machinery. Additionally, it provides engineering consultancy services to industries such as ports, construction, civil engineering, and underground infrastructure. The types of equipment it offers include foundation engineering equipment, hoisting devices, excavation machinery, and port machinery.