Cailian Press, July 11th (Editor Zhao Hao) – On Thursday (July 10th), the three major U.S. stock indices collectively rose, with both the S&P and NASDAQ ending at new highs.

By the close of trading, the Dow Jones Industrial Average had risen by 0.43%, to 44,650.64 points; the S&P 500 index had increased by 0.27%, to 6,280.46 points, surpassing its previous high from last Thursday; the Nasdaq Composite Index had risen by 0.09%, to 20,630.66 points, setting a record for two consecutive days.

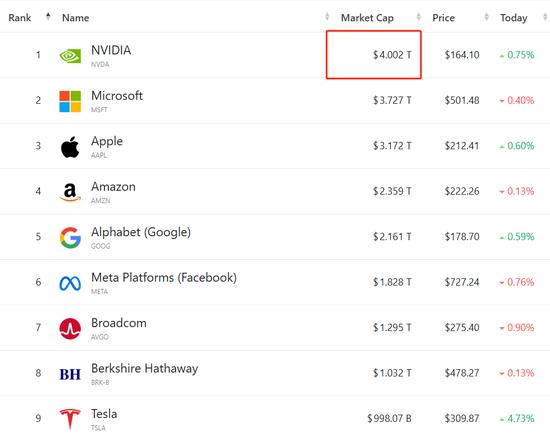

Major tech stocks saw mixed results, with Nvidia’s total market value reaching above $4 trillion for the first time at the close of trading. Tesla surged by 4.73%, with CEO Elon Musk revealing that autonomous taxi services are expected to expand to the San Francisco Bay Area within “one or two months.”

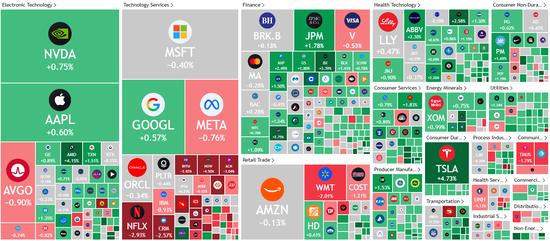

Spotlight on the S&P 500 Index

Currently, the U.S. stock market is caught in a series of contradictory risks including tariffs, fiscal policies, and the outlook of the Federal Reserve. The day before yesterday, according to news reports, Trump stated that the United States would impose a 50% tariff on imported copper, effective from August 1st.

Earlier in the day, Trump once again urged Federal Reserve Chairman Jerome Powell to cut interest rates. The day before, he mentioned that the Fed’s set interest rate was at least 3 percentage points higher than necessary, with each percentage point costing the U.S. $360 billion in refinancing costs annually.

Professional trader Tom Essaye commented that given the uncertainty about the scope of tariffs before August 1st, it means that cutting interest rates this month is “impossible.” He also pointed out that postponing the deadline reduces the likelihood of central banks taking action in September.

The Chair of the St. Louis Federal Reserve, Murtha, believes there is an upward risk to inflation in the United States, but it is still too early to determine whether it will have a lasting impact on prices. San Francisco Federal Reserve’s Daley believes that the impact of tariffs on prices might be smaller than expected.

Horizon Investment’s executive Mike Dickson stated that it is incredible to think that the US stock market could still be above its initial levels by mid-year, given the uncertainties brought about by tariffs. “The reason I can think of is that the market has become accustomed to these volatile fluctuations,” he said.

Major tech stocks saw mixed results, with Nvidia up 0.75%, Microsoft down 0.4%, Apple up 0.6%, Amazon down 0.13%, Google C+ up 0.59%, Meta down 0.76%, Boson down 0.9%, and Tesla up 4.73%.

The Philadelphia Semiconductor Index rose 0.75%, with only six out of thirty constituents falling. Teradyne surged 6.29%, the largest gain; Advanced Micro Devices (AMD) rose 4.15%, Intel increased by 1.62%; Texas Instruments rose 1.51%, reaching a new historical high.

Just before the report was published, Bitcoin broke through the $117,000 mark, setting a new record. Cryptocurrency stocks strengthened, with Strategy up 1.52%, Coinbase up 4.04%, Robinhood up 4.4%, and “Stablecoin First Stock” Circle up 1.11%.

Delta Air Lines closed up 11.99%, led by a rebound in demand, driving the airline sector higher. United Airlines rose 14.33%, American Airlines increased by 12.72%.

Rare earth stocks soared, with MP Materials up 50.62%, receiving a multi-billion dollar deal from the U.S. Department of Defense; NioCorp Developments up 26.97%, Energy Fuels up 16.46%.

Chinese concept stocks generally rose, with the Nasdaq China Gold Dragon Index up 0.9%.

Popular Chinese concept stocks mostly advanced, with ZTO Express up 9.21%, Beike up 6.52%, and Xiaomi Autonomous Driving up 6%.

18%, NIO surged 6.03%, Alibaba rose 2.71%, New Oriental increased by 0.74%, Good Futures climbed by 0.09%, and Li Auto gained 0.07%.

Regeneron Medical dropped 4.43%, Tencent Music fell 1.72%, XPeng Motors declined 1.25%, JD.com dipped 1.2%, Baidu plummeted 0.25%, and Pinduoduo dropped 0.03%.

[Delta Air Lines Revises FY Profit Forecast, Q2 Net Profit Up 63% Year-on-Year]

Delta Air Lines announced its financial results for the second quarter of 2025, with net profits of $2.13 billion, up 63% year-on-year. Additionally, Delta Air Lines has revised its financial forecast for the fiscal year, expecting earnings per share to range between $5.25 and $6.25, and free cash flow to reach between $3 billion and $4 billion.

[Ferrero Group Agrees to Acquire WK Kellogg Co]

On Thursday, Ferrero Group announced on its official website that it has agreed to acquire WK Kellogg Co for $23 per share in cash, with a total transaction value of $3.1 billion. The deal is expected to be completed in the second half of this year, but approval from shareholders and regulatory bodies is still required. WK Kellogg Co’s stock rose by 30.63%.

[Polestar Motors Revenue Surge by 51% in First Half of the Year]

Polestar Motors reported that its retail sales in the second quarter of 2025 amounted to 18,049 units, marking a 38% increase compared to the same period last year. In the first six months of the year, retail sales reached 30,319 units, up by 51% compared to the same period last year. Polestar Motors’ stock rose by 4.59%.

[Ant International Denies Rumors of Collaboration with Circle’s Stabilized Currency]

In response to media reports about Ant International’s collaboration with Circle’s stablecoin, Ant International stated: “The media report is inaccurate; there is no such plan at present.”

[JPMorgan CEO Jamie Dimon: The Fed’s Rate Hikes Are Higher Than Market Estimates]

JPMorgan Chase CEO Jamie Dimon stated that there is a possibility of interest rate hikes by the Federal Reserve. “I believe the probability of rate hikes is higher than others anticipate,” said Dimon, “If the market pricing reflects a 20% likelihood, then my estimate is between 40% to 50%.”