According to financial news, foreign media reports indicate that

Copper has become the “number one emerging target for theft” in the United States.

This year, global copper prices have risen across the board, with the US market experiencing a surge of over 35%. Risk assessment firm Verisk CargoNet had already listed copper as the “number one emerging target for theft” last year, with data showing that in 2024, the number of thefts in the US-Canada logistics industry surged by 26% to 3,798 cases, with copper-related crimes contributing significantly. The organization expects that the number of cases will reach new heights in 2025, with copper theft reported in the first half of the year alone increasing by 61% compared to the same period last year, and there is widespread underreporting within the industry.

“Crimesters always chase goods that are high in value and easy to sell,” notes Keith Lewis, Vice President of Operations at Verisk CargoNet.

Copper is widely used in industries such as data centers, automobiles, energy, etc. With international copper prices breaking through historical peaks, any material containing copper in the United States has become a “pie of gold” for criminals.

According to a report by The Wall Street Journal on October 10th, now, thieves have extended their hands to bulk copper materials during transportation.

The rate of stolen truckloads of copper in the United States has even outpaced the rise in copper prices.

President Trump announced that

he would impose a 50% tariff on all imported copper into the United States starting from August 1st.

In a post on social media platform “Reality Social,” Trump stated that copper is a critical metal in many technological fields. He said after receiving the relevant “National Security Assessment,” “I declare a 50% tariff on copper effective from August 1, 2025.” He expressed his intention to reclaim the “dominant position” of the American copper industry.

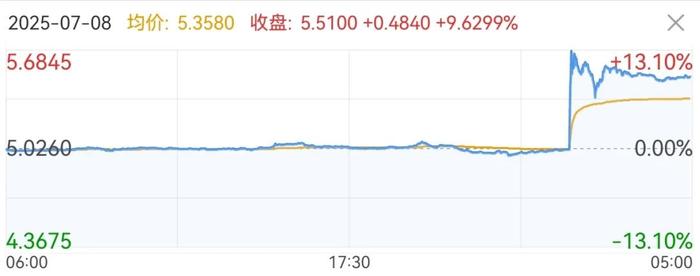

Following this announcement, the price of copper futures on the New York Mercantile Exchange soared straight up, reaching an intraday increase of over 13%.

On July 11th, after three consecutive days of gains, the New York Mercantile Exchange (COMEX) copper futures closed lower. As of this writing, it was reported at $5.584 per pound, reaching a weekly high of $5.8955 and setting a new historical peak.

Meanwhile, the London Metal Exchange (LME) copper futures prices were under pressure, with a cumulative weekly decline of 2.04%. As of this report, it was quoted at $9663 per ton, rebounding from the low of $9553 per ton reached on Wednesday. The main contract for Shanghai copper closed down by 0.27%, at $78,320 per ton, with a cumulative weekly decline exceeding 2%.

According to Xinhua Finance, the market is still speculating about the future trend of copper prices. High tariff expectations and the off-season demand are constraining domestic copper prices. However, due to tight supply at the mining end, coupled with inventory levels remaining low after accumulation, there is still support for copper prices at the bottom.

Chanyuan Tiancheng Futures research report pointed out that attention should be paid to the trend in the United States demand side and the timing of tariff implementation. Since Comex’s inventory has accumulated to a considerable extent, if there is a significant change in demand, the risk of arbitrage increases, and the price difference logic cannot be maintained over the long term. Overall, for Shanghai copper and London copper in the short term, the logic of relocation may start to reverse. In the long term, the contradiction between supply and demand remains the main theme, with support at the bottom.

According to a commentary by Shanghai Nonferrous Metals Network, under the backdrop of high tariffs, copper not shipped to the United States might shift towards non-US regions, which could alleviate the tight supply situation in non-US markets. Coupled with the off-season leading to weak downstream demand, it collectively exerts upward pressure on copper prices.

“For the future, the key variable lies whether there will be unexpected economic data or policy benefits both domestically and internationally. If such macro-level ‘warm winds’ emerge, they might offset the downward pressure brought by tariffs on copper,” Shanghai Nonferrous Metals Network commented in its commentary.

Fan Rui, the head of the non-ferrous metals research group at Guoyuan Futures, believes that although the inventory accumulation process has begun, due to the current low level of copper inventories, there will not be a significant price pressure from additional inventory surplus during the accumulation process. Additionally, the continuous tightness in overseas ore and scrap copper supplies, coupled with the expected maintenance period for domestic smelters from September to October, is expected to boost the focus of Shanghai copper prices.

Jiang Lu, the chief researcher at CITIC Construction Investment Futures Metals, views copper prices as being difficult to completely reverse the short-term tight situation of spot Shanghai copper and London copper, but the market price may still have some support. However, with the recent accumulation of U.S. copper inventories, the supply of copper in the U.S. market has already reached an oversupply situation, leading some to believe that there is still a risk of downward trends in copper prices in the long term, and the market should not be too optimistic.

Jiang Lu mentioned that if tariff policies are implemented and take effect, the copper spot in logistics will face backflow pressure, while the U.S. copper market will face excess inventory pressure, potentially leading to a scenario where U.S. copper prices correct and Shanghai/London copper prices fall back.