On the evening of July 16th, the global market experienced a shocking moment. Shortly before,

President Trump might soon dismiss Federal Reserve Chairman Jerome Powell.

According to The New York Times,

Trump has drafted a letter to dismiss Federal Reserve Chairman Powell.

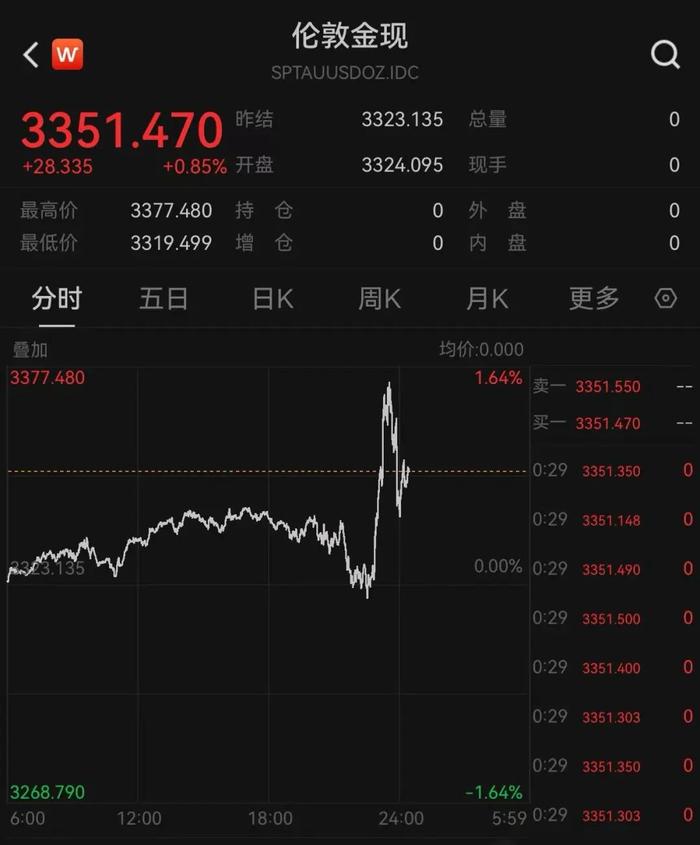

Following the news, the three major U.S. stock indexes plummeted, gold prices surged,

reaching $3377 per ounce, at one point increasing by 1.64%,

but soon after, the market underwent a significant reversal.

CCTV International News on July 17th reported that, during lunchtime in local time on July 16th, Trump once again emphasized to reporters about Federal Reserve Chairman Powell, “Powell is terrible and not doing his job well.” However,

regarding reports from several American media outlets earlier stating that “Trump might soon fire Powell,” Trump stated that there are currently no plans to take any action, nor have he drafted a letter to dismiss Powell as some U.S. media outlets reported.

However, he did discuss the topic with lawmakers and mentioned that personnel adjustments would be made within eight months—Powell’s term should end in May next year.

He “probably won’t fire Powell unless fraud is proven”. He also mentioned that White House economic advisor Kevin Hassett is someone he is considering for the Fed position. The day before, Trump also said Treasury Secretary Steven Mnuchin was a candidate for the Fed chairman position.

Powell was appointed by Trump during his last presidential term. Since Trump returned to the White House this year, he has frequently pressured the Fed to cut interest rates, criticized Powell multiple times, and threatened to remove his role as Fed Chairman. Powell stated that President Trump does not have the legal authority to dismiss him, and he will continue working until his term ends, which is May 2026.

Recently, the Trump administration has attempted to “fire” the Federal Reserve Chairman ahead of Powell’s term expiration by using the high cost of renovations at the Fed headquarters as a new “breakthrough point.”

Following this news, the three major U.S. stock indices nearly recovered their losses during trading.

The increase in international gold prices also narrowed.

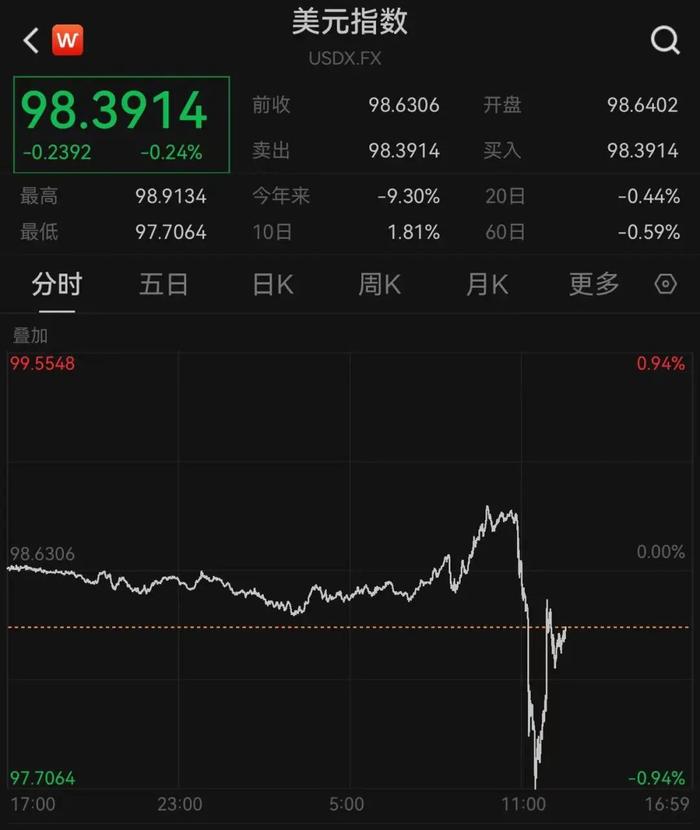

The U.S. dollar index briefly plummeted before rallying.

The Fed’s renovation project exceeded its budget by $700 million.

Trump: Enough to Fire Powell

On July 15th local time, President Trump stated that the cost overruns in the renovation of the Fed headquarters were sufficient reasons to fire the Federal Reserve Chairman, Powell.

During a conversation at the airport, when asked if the renovation issues constituted “something that could be fired for,” Trump said, “I think so.”

Since the beginning of this year, Trump has repeatedly criticized Powell and threatened to fire his position as Federal Reserve Chairman, pressuring the Fed to cut interest rates. Recently,

the Trump administration frequently mentioned the $2.5 billion renovation project at the Fed building, which resulted in “cost overruns,” adding pressure on Powell.

The renovation project at the Fed building began construction under former President Joseph Biden. According to U.S. media reports, the initial budget for the project in 2019 was set at $250 million.

However, due to significant increases in costs for timber, steel, and cement,

the budget was increased to nearly $2.5 billion.

On July 2nd, the Trump administration requested Congress investigate Powell for “political bias” and “false statements made in Congress,” accusing Powell of leading the renovation project at the Fed headquarters with significant violations, including luxury renovations. He also claimed that Powell deliberately concealed facts and adopted a negative attitude during congressional inquiries,

which should warrant “dismissal and accountability.”

In response to inquiries, Powell admitted that the renovation expenditures exceeded the budget but denied the luxury renovation allegations, arguing that

the renovation was necessary to meet “safety and modernization” requirements.

On the 11th, the Federal Reserve defended its $2.5 billion renovation budget on its official website, stating that “this project involves a comprehensive renovation and modernization of two historic buildings, which have never been systematically renovated since their construction in the 1930s.”

On the 13th, U.S. White House economic advisor Hecht openly declared in a media interview that if there were legitimate reasons, Trump had the right to fire Federal Reserve Chairman Jerome Powell.

He also accused the Federal Reserve of “having a significant responsibility” for the overrun on its Washington headquarters renovation project. Hecht stated that whether Powell would be fired due to an “overrun of $700 million” would largely depend on the response from the Federal Reserve to Russell Wade’s request for advice on the White House’s management and budget office.

On the 13th, Trump also expressed his opinion that if Federal Reserve Chairman Powell resigned, it would be a good thing. Trump said, “I hope he resigns, he should resign because he is very unfavorable to the country.”

Additionally, on the 9th, Trump had previously stated that the Federal Reserve’s interest rate setting was at least 3 percentage points higher than normal.

The U.S. core CPI rose by 2.9% year-on-year in June according to Xinhua News Agency.

According to reports by Xinhua News Agency, the U.S. government announced on the 15th that the consumer price index for June showed the largest year-on-year increase since February.

As reported by American media, this indicates that President Trump’s tariff policies are putting pressure on Americans, leading to a shrinking wallet for ordinary consumers.

Data released by the U.S. Bureau of Labor Statistics on the same day showed that the U.S. consumer price index for June rose by 2.7% year-on-year, exceeding market expectations and marking the largest year-on-year increase since February. Excluding fluctuations in food and energy prices, the core inflation rate in the U.S. for June increased by 2.9% year-on-year.

Economists believe that the data released that day also serves as a warning to the Trump administration about the tariffs it plans to impose starting August 1.

Some experts believe that an increase in inflation rates could signal that the Trump administration’s implementation of new tariffs will lead to a significant rise in prices.

Gregory Daco, Chief Economist at Ernst & Young-Boston Consulting Group, estimates that if the new tariffs are implemented on August 1st, the average tariff rate in the United States could rise to 21%, triggering “significant economic risks.”

White House Press Secretary Karine Jean-Pierre attempted to downplay the impact of inflation data on the 15th, emphasizing that core inflation remains consistent with analysts’ expectations. President Trump himself stated that the economic data is “excellent,” and “we have no inflation.”

On the same day, Trump once again requested the Federal Reserve to cut interest rates. The Fed, not yielding to Trump’s pressure, remained cautious. Trump has repeatedly criticized Fed Chairman Jerome Powell over the past few months and threatened to remove him from office. On the 15th, U.S. Treasury Secretary Steven Mnuchin said that the White House had begun selecting potential successors for Powell. Reportedly, Mnuchin himself is also among the potential candidates.

However, according to The New York Times, given evidence that tariff policies are beginning to affect prices, even some of Trump’s allies admit that the Fed is unlikely to decide to cut interest rates at its monetary policy meeting later this month. Conservative economist Stephen Moore, who was once a Trump advisor, believes that even if it would anger Trump, the Fed might remain inactive this month. However, the White House needs to fully focus on the level of inflation, ensuring it does not rise to 3% or 4%. “Otherwise, people will start realizing, ‘Oh, these government policies are failing.'”

It is worth mentioning that Powell responded to Trump earlier this month,

stating that the Fed’s monetary policy must be “entirely non-political,” reiterating that the central bank continues to observe the impact of U.S. tariffs before making further decisions.

Powell’s term should end in May 2026.

According to U.S. law, although the Federal Reserve Chairman is nominated by the President of the United States, the Fed does not directly report to the President and enjoys a high degree of independence. Since the interest rate cut in December last year, the Fed has maintained the benchmark interest rate unchanged. In recent months, Trump has repeatedly criticized Powell for failing to cut rates.

Analysts believe that since the establishment of the Fed, no president has ever fired the Chair. If Trump breaks this tradition, it would mean that the independence of the Fed as the central bank of the United States is undermined. The so-called “market economy” and “independence of policies” that the United States has always prided itself on are being eroded by political plans and administrative interventions in the United States.

The analysis suggests that if the independence of the Fed is questioned, confidence in the dollar and U.S. monetary policy worldwide will decline. Looking ahead, this is not just an issue at the economic or policy level but could also lead to new turmoil in domestic political maneuvering within the United States.

(Disclaimer: The content and data provided here are for reference only and do not constitute investment advice. Investors should act based on this information at their own risk.)