On July 24th, local time, Trump visited the Federal Reserve to discuss interest rate issues, hoping for a rate cut to save trillions of dollars and hinting at the potential firing of Powell. The stock market closed with mixed results, with Tesla falling by 8.20%, wiping out $87.8 billion in market value due to a 12% revenue decline in the second quarter and a 13% year-on-year decrease in sales. CEO Elon Musk warned that the company would face “a few tough quarters” ahead. In international markets, gold futures closed lower, while crude oil futures closed higher.

According to news on July 25th, local time, on July 24th, the United States… said, “This conversation was very effective.”

He expressed hope that Powell could lower interest rates, stating that if interest rates were reduced by three percentage points to one percentage point, the US could save over ten thousand billion dollars. He will observe how the committee will set interest rate rules.

Powell’s comments indicated that this would be a significant move.

Powell stated that he expects the renovation project to be completed by 2027.

He mentioned that he usually fires project managers who exceed budget.

American media reported that this is the first formal visit by a US president to the Federal Reserve in nearly 20 years, marking an escalation of pressure from Trump on Federal Reserve Chairman Powell.

Photo source: Visual China – VCG111554851285

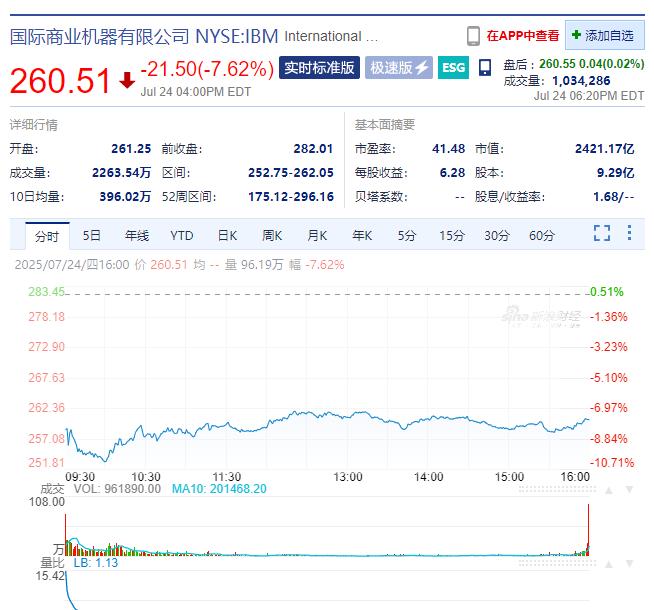

In terms of the market, as of local time on July 24th, the three major US stock indexes closed with mixed results. The Dow Jones Industrial Average fell by 0.7%, the Nasdaq Composite rose by 0.18%, and the S&P 500 Index increased by 0.07%. Popular technology stocks saw mixed performance, with IBM dropping more than 7%, Nvidia, Amazon, and Boson rising by more than 1%. Sectors such as semiconductors and oil and gas were up, with American Pixel rising by more than 7%, AMD increasing by more than 2%, and ASML and Micron Technology rising by more than 1%. Automotive manufacturing and space exploration stocks were among the top losers, with Lotus dropping more than 5%, Honda Motor and Virgin Galactic falling by more than 2%.

Tesla fell by 8.20%, closing at $305.30, with a market value of $983.3 billion.

A total of $5.8 billion, its market value evaporated overnight by $87.8 billion (approximately 628.2 billion yuan).

Tesla’s second-quarter financial report showed that the company’s revenue for the quarter was $22.496 billion, a decrease of 12% compared to the same period last year, marking the company’s most severe quarterly revenue decline in over a decade.

The report indicated that vehicle sales revenue was $16.661 billion, down 16% year-on-year; energy storage revenue was $2.789 billion, down 7% year-on-year; and service revenue was $3.046 billion, up 17% year-on-year. Gross profit was $3.878 billion, down 15% year-on-year, with a gross margin of 17.2%, a decrease of 0.8 percentage points from the same period last year.

In terms of sales, Tesla delivered a total of 384,122 vehicles in the second quarter, a decrease of 13% compared to the previous year. Among these, sales of Model Y and Model 3 decreased by 12% year-on-year, while sales of high-priced models including Cybertruck saw a decline.

CEO Elon Musk warned that the company would face “a few tough quarters” ahead.

This is the most direct statement of his outlook on the company’s future so far. He mentioned that the tax bill signed this month in the United States will gradually eliminate the tax credit for purchasing electric vehicles, weakening federal fuel economy standards, all of which will impact Tesla.

Intel reported a revenue of $12.86 billion in the second quarter, a year-on-year increase of 0.2%, with an estimated revenue of $11.88 billion, and a net loss of $2.92 billion, compared to a loss of $1.61 billion in the same period last year. The adjusted earnings per share for the second quarter were $0.10, compared to $0.02 in the same period last year, with an estimated adjusted earnings per share of $0.01. The company expects revenue between $12.6 billion and $13.6 billion in the third quarter, with market estimates at $12.64 billion.

Intel plans to cut its workforce by about 15%. As of the publication, Intel’s stock price fell by 3.7% after-hours.

IBM’s software sales were weak, leading to its stock price reaching its lowest since 2021. In its financial report released on July 23, IBM’s software division’s sales fell short of expectations, disappointing investors and causing its stock price to reach its lowest in four and a half years. IBM stated that its software division’s revenue grew by 10% in the second quarter, reaching $7.39 billion, slightly below the average analyst estimate of $7.49 billion. Its consulting business saw a slight increase in revenue this quarter, up by 3%, to $5.31 billion, following a period of growth slump.

Popular Chinese concept stocks generally closed lower, with the Nasdaq China Gold Dragon Index falling by 1.54%, Mingchuang Youpin rising more than 8%, XPeng Motors rising more than 1%, Baidu and Li Auto falling more than 2%, and Bilibili falling more than 4%.

The FTSE A50 futures closed down 0.19% during the night session, at 14024 points.

COMEX gold futures closed down 0.77%, at $3371.3 per ounce. COMEX silver futures closed down 0.55%, at $39.285 per ounce.

WTI crude oil futures closed up 1.2%, at $66.03 per barrel. Brent crude oil futures closed up 1%, at $69.18 per barrel.