Cailian Press, July 25th (Editor: Huang Junzhi)

Tesla’s second-quarter report reveals that despite a continuous decline in car sales, its revenue and net profit for the quarter fell by double digits, failing to meet expectations. However, amidst this disappointing financial statement, one “mistake” has been overlooked—missing out on the significant gains from the Bitcoin price surge.

The report shows that the company’s digital assets are valued at $1.24 billion. Although this figure represents a significant increase from $722 million a year ago, anyone paying attention to the cryptocurrency market will not fail to notice that this essentially means the electric vehicle manufacturer missed out on billions of dollars in “potential earnings.”

Following the latest financial report, Tesla’s stock plummeted by 8% on Thursday, with a cumulative decline of about 20% since the beginning of the year, making it the largest drop among the seven major tech giants.

As early as 2021, Tesla had purchased $1.5 billion worth of Bitcoin, betting on the “long-term potential” of this digital currency and hoping to “add more flexibility to the company’s cash reserves, further diversify its portfolio, and maximize returns.” The CEO, Elon Musk, was also generously open about his support, with Bitcoin soaring by 20% within a day due to his endorsement.

However, by mid-2022, the global market landscape had changed significantly. The prosperity of the “COVID era” had passed, replaced by soaring inflation and rising interest rates, prompting investors to withdraw from risky assets.

Tesla was no exception. In the second quarter of that year, the company announced it had sold three-quarters of its Bitcoin holdings, coinciding with a simultaneous crash in both the stock and cryptocurrency markets, which added cash to the company’s balance sheet. That year, Tesla’s market value shrank by about two-thirds, and the price of Bitcoin dropped by 60%.

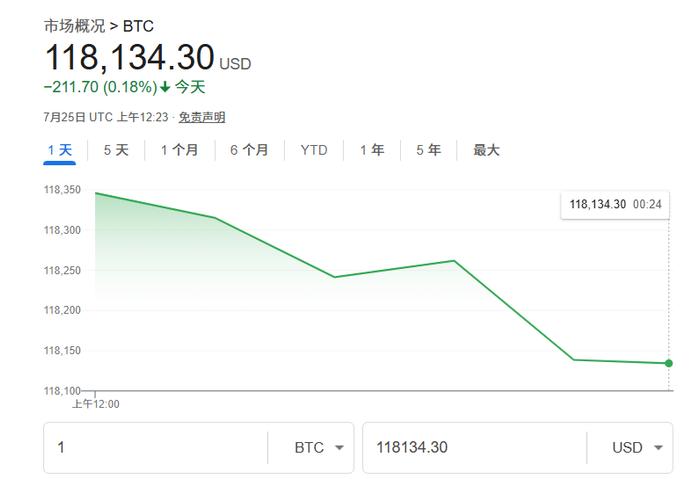

However, since then, Bitcoin has seen a significant rebound. The Trump administration’s efforts to relax regulations and the commitment to establishing a strategic reserve for Bitcoin have further boosted Bitcoin. Currently, the trading price of Bitcoin exceeds $118,000, an increase of about sixfold compared to the end of the second quarter in 2022 (when Tesla significantly sold off its Bitcoin holdings).

Based on the estimated amount of Bitcoin purchased by Tesla in 2021, if Tesla had not sold off this 75% stake, the current valuation of digital assets would have reached $5 billion rather than the current $1.24 billion. The $936 million in Bitcoin cashed out by the company at that time, valued at current prices, exceeds $3.5 billion.

Despite Musk’s explicit statement that his electric vehicle company’s future focus will be on autonomous taxis and humanoid robots, not cryptocurrency investments, the company’s operations are currently struggling. Tesla also acknowledges that President Trump’s tariff policies and the expiration of federal electric vehicle tax credits could harm the company’s core business in the coming quarters.

The second-quarter financial report also shows that Tesla’s digital assets are boosting its profitability. In the second quarter, Bitcoin generated earnings of $284 million, while the total net income of the company was $1.17 billion. Therefore, analysts believe that Tesla is actually very much in need of cash injections. Had it not missed out on the Bitcoin rally, it might not have been as difficult today.