On the eve of the August 1st tariff deadline, which is less than 24 hours away, global trade negotiations have entered a heated phase. Delegations from several major trading partners in the United States are convening in Washington to engage in final intense discussions with the Trump administration. According to news reports on July 15th, local time, President Donald Trump stated that tariffs would begin on August 1st.

The latest developments at the White House have heightened the sense of urgency. Media sources quoted a White House official on the 31st confirming that Trump plans to sign a new executive order on Thursday, imposing higher tariffs on countries that fail to reach an agreement. On July 30th, Trump announced through social media:

“The last deadline on August 1st is the last deadline—it stands firm and will not be extended.”

Meanwhile, according to reports, Trump has announced that he will impose a 25% tariff on goods imported from India starting on August 1st, surpassing the 15% to 20% range imposed on other Asian countries. Trump also threatened additional penalties for India’s purchases of energy from Russia. A series of baffling moves has made the situation even more complex.

Despite the exceptionally tense diplomatic efforts, the US market has so far shown little reaction, with the S&P 500 index reaching a historic high. However, some Wall Street institutions have warned that the market may be overly complacent, underestimating the potential impact of a shift in trade policies on the economy and markets.

As the deadline approaches, Washington has become the center of global trade negotiations. Media sources revealed that Canada and Mexico, two of America’s key allies, have dispatched delegations and are engaging in tense closed-door talks with US officials.

Despite the overnight negotiations, the outlook remains uncertain. Canadian Prime Minister Justin Trudeau expressed a cautious attitude towards the progress of the talks on Wednesday evening, stating:

“The negotiations are complex, comprehensive, and constructive, but it is possible they will not conclude before August 1st.”

Meanwhile, some countries seem to have made breakthroughs. On Wednesday evening, the Trump administration announced a preliminary agreement with South Korea. According to news, on July 30th local time, Trump stated that he had reached a trade agreement with South Korea, which would impose a 15% tariff on South Korea. Trump claimed that South Korea would provide $350 billion to the United States for investment projects owned and controlled by the U.S., and personally selected by me, the President of the United States.

Trump’s tough stance and personal intervention

In this round of negotiations, President Trump himself was deeply involved. Insiders say that Trump has repeatedly vetoed potential agreements proposed by his senior aides, including the Secretary of Commerce, Robert Lighthizer, and the U.S. Trade Representative, Jason Krueger, demanding more concessions from the U.S.

Trump’s personal intervention even went into specific negotiations. Two sources familiar with the talks revealed that as negotiations with India progressed, Trump had personally joined calls with the Indian Trade Minister and Lighthizer. He told the media on Wednesday that the U.S. is negotiating with only a few major countries, while “we are just sending out bills” to other nations.

Media sources quoted a White House official who confirmed that Trump will sign a new executive order before midnight Thursday to determine the final tariff rates. This move aims to prevent tariffs from automatically reverting to the original levels announced in April. It remains unclear whether Trump will announce his victory through public events or simply sign the order privately.

For economies with smaller size or unique trade structures, meeting the U.S. demands is almost an impossible task. For example, Switzerland does not impose tariffs on American industrial goods, but due to its large export of high-value-added pharmaceuticals and high-end machinery to the U.S., it faces a significant trade surplus.

Rahul Sahgal, CEO of the Mercer Group, pointed out that even if Switzerland’s population were to increase to 8.8 million people, “eating a steak every day, drinking a bourbon whiskey, and buying a Harley-Davidson motorcycle,” it would hardly change the trade balance.

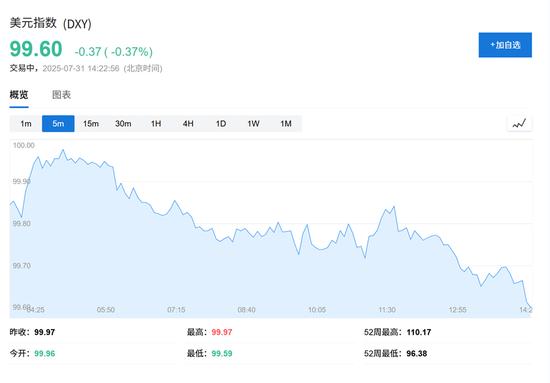

The market appears calm beneath the surface tensions in diplomacy. In stark contrast, the American financial markets have shown remarkable resilience. The S&P 500 index has continued to rise, and the dollar has reached a few months high at 99.6 points. Traders seem to be betting that Trump will ultimately not implement tariffs that could shake the market.

However, some analysts issued warnings about this. A Morgan Stanley report to clients stated:

“The deadlines keep coming and going, tariffs rise… But economic data and the market haven’t collapsed. Therefore, it’s easy for people to no longer believe that US trade policies will impact the market. Please resist this temptation.”

In an interview on Tuesday, US Treasury Secretary Steven Mnuchin attempted to downplay the impact, stating:

“I think if these retaliatory tariffs are just effective for a few days or weeks, as long as the relevant countries continue to negotiate with sincerity, it’s not the end of the world.”