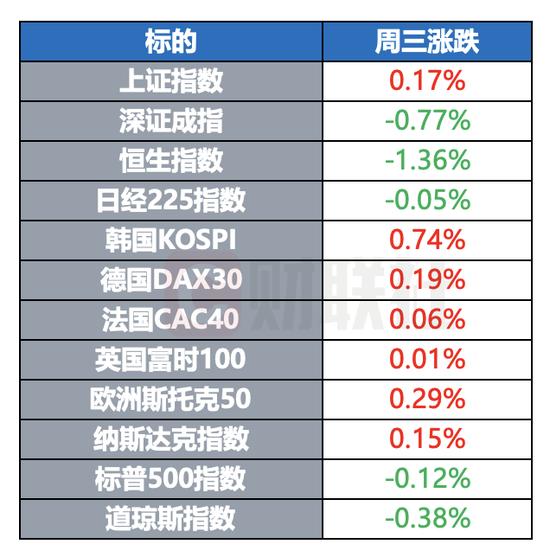

Global major indices saw mixed results on Wednesday, with only the Nasdaq index showing a slight increase. The latest speech by Federal Reserve Chairman Powell has dampened market expectations for interest rate cuts.

WTI crude oil futures closed up 1.14%, at $70 per barrel. Brent crude oil futures closed up 1.01%, at $73.24 per barrel.

COMEX gold futures closed down 1.58%, at $3327.9 per ounce. COMEX silver futures closed down 2.9%, at $37.175 per ounce.

[Federal Reserve maintains the federal funds rate target range unchanged at 4.25% to 4.50%]

The Federal Reserve maintained its decision to keep interest rates unchanged at 4.25% to 4.50%, in line with market expectations and marking the fifth consecutive time it has decided not to change rates.

[Powell: No decisions made regarding September meeting; impact of tariffs on inflation still to be observed]

On Wednesday, Eastern Time (July 30), Federal Reserve Chairman Jerome Powell stated during a press conference following the interest rate meeting that policymakers had not yet made any decisions regarding the September rate hike, and moderately restrictive policies remain appropriate. The impact of tariffs on inflation is still to be observed.

[Trump claims trade deal with South Korea; 15% tariffs to be imposed]

On July 30, local time, President Donald Trump announced that the United States had reached a “complete and full” trade agreement with South Korea.

According to the agreement, South Korea will provide the United States with $350 billion in investments, owned and controlled by the U.S. Additionally, South Korea will purchase $100 billion worth of liquefied natural gas or other energy products, and commit to investing a significant amount of capital for its own investment purposes. This amount will be disclosed two weeks after South Korean President Moon Jae-in’s visit to the U.S. for bilateral talks.

Trump stated that both sides in the U.S. and South Korea have agreed that the United States will impose a 15% tariff on South Korea. Meanwhile, the United States will not be subject to tariffs.

South Korea will fully open its trade to the United States, accepting products including automobiles, trucks, and agricultural products.

[Trump announces a 50% tariff on imported semi-finished copper products and copper-intensive derivatives starting August 1]

The White House in the United States announced on July 30th that President Donald Trump has declared a 50% general tariff on imported semi-finished copper products and copper-intensive derivatives effective from August 1st. The White House stated that raw copper materials and copper scrap are not subject to the “232 clause” or equivalent tariff restrictions. On July 9th, President Trump announced that he would impose a 50% tariff on all copper imported into the United States starting from August 1st. American media have warned that this move could lead to a surge in costs for American manufacturers, causing a significant blow to the U.S. manufacturing industry.

[Trump signs an executive order to impose a 50% tariff on Brazil]

On July 30th, the White House in the United States stated that President Trump had signed an executive order to impose a 40% tariff on Brazil, bringing the total tariff amount to 50%. Trump had previously announced that he would impose a 50% tariff on goods imported from Brazil starting from August 1st.

[Trump: India will pay a 25% tariff]

On July 30th, President Trump announced on his social media platform “Reality Social” that the United States would impose a 25% tariff on goods imported from India starting from August 1st.

[U.S. suspends minimum duty exemption for low-value goods]

The White House in the United States issued a statement on July 30th, stating that President Trump had signed an executive order to suspend the minimum duty exemption for low-value goods. The statement said that starting from August 29th, imported goods valued at or below $800 through international postal networks will be subject to all applicable tariffs. For goods shipped via the international postal system, the tariffs will be imposed based on either ad valorem or volumetric tax.

[Ukrainian Defense Minister: “Very Close” to Having Weapons Capable of Strike Targets in Russia]

On the 30th, Ukrainian Defense Minister Shmyhal stated in an interview that Ukraine is actively developing ballistic missiles and is very close to acquiring weapons capable of striking targets within Russia. This goal may be achieved soon. He also mentioned that President Zelenskyy has announced that Ukraine will have its own ballistic missile system.

[Microsoft: Net Profit for the Fourth Quarter Reached $27.2 Billion, a Year-on-Year Increase of 24%]

Microsoft’s revenue for the fourth quarter was $76.44 billion, up 18% year-on-year, with an estimated $73.89 billion, including $29.88 billion from its smart cloud business, which was estimated at $29.1 billion. The net profit for the fourth quarter reached $27.2 billion, a year-on-year increase of 24%, with earnings per share at $3.65, up from $2.95 in the same period last year.

After-hours trading saw Microsoft’s stock jump more than 7%.

[Meta’s Net Profit for the Second Quarter Reached $18.337 Billion, a Year-on-Year Increase of 36%]

MetaPlatforms Inc. reported second-quarter revenue of $47.52 billion, up 22% year-on-year, with an estimated $44.83 billion, and net profits of $18.337 billion, up 36% year-on-year, operating profit of $20.44 billion, up 38% year-on-year, with an estimated $17.24 billion, resulting in a company’s second-quarter earnings per share of $7.14, up from $5.16 in the same period last year, with an estimated $5.89. Meta currently expects capital expenditures for the full year to be between $66 billion and $72 billion, a slight increase from its previous range of $64 billion to $72 billion.

Meta’s stock surged more than 10% after-hours.

[Qualcomm’s Adjusted Net Profit for the Third Quarter Was $2.67 Billion, a Year-on-Year Increase of 25%]

Qualcomm’s adjusted revenue for the third quarter was $10.37 billion, up 10% year-on-year, with analysts expecting $10.6 billion.

16 dollars, adjusted net profit of 2.67 billion USD, a year-on-year increase of 25%, adjusted earnings per share for the third quarter were $2.77, with an estimate of $2.72. The company expects revenue in the fourth quarter to be between $10.3 and $11.1 billion, with an estimate of $10.61 billion. For the fourth quarter, adjusted earnings per share are expected to range from $2.75 to $2.95, with an estimate of $2.84.

[US Steel Inc. Adds Three Independent Directors to its Board]

US Steel Inc., Japan Steel Works, and its wholly-owned subsidiary, Japan Steel Works North America, announced on July 30 that three independent directors have been appointed to the board of US Steel Inc. The current board of US Steel Inc. consists of seven directors, four of whom are American citizens, including three independent directors.

[Baidu’s Search Engine Homepage Will Fully Open the Smart Entity Entry]

Baidu’s search engine homepage is currently testing the entry point for smart entity applications. Users can access these smart entities directly by clicking “AI Application Entry” below the search box.

According to insiders at Baidu, the smart entities integrated into Baidu’s search engine homepage mainly come from Wenxin Intelligent Platform, external high-quality AI applications accessed through the search open platform, as well as some of Baidu’s proprietary applications. This feature is currently undergoing a pilot test and is expected to be fully opened soon.