[Introduction] Fed Chairman Powell Signals a Possible Interest Rate Cut in September

Tyler, China Fund News

Hey guys, tonight investors all over the world are closely watching the speech of Fed Chairman Powell at the annual central bank meeting in Jackson Hole, Wyoming. The market is hoping to find clues about the interest rate path.

Tyler has sorted out the highlights of his speech and the latest market reaction!

Powell left room for a rate cut at the meeting on September 16-17, stating that “changes in the baseline outlook and risk balance may require us to adjust our policy stance.”

He also said, “The stability of the unemployment rate and other labor market indicators allows us to proceed with caution when considering policy adjustments.”

When referring to the labor market, Powell pointed out that “while it appears balanced on the surface, this is a peculiar balance, stemming from significant slowdowns in both labor supply and demand. This abnormality indicates that downside risks to employment are rising.”

He suggested that a “reasonable baseline scenario” is that tariffs will cause a one-time rise in price levels, but these effects will take time to fully pass through the economy.

Powell stated, “In the short term, inflation risks are biased upward while employment risks are biased downward – this is a challenging situation.”

Powell also mentioned that the Fed has adopted a new policy framework, deleting statements about “pursuing inflation that averages 2% over time” and “making decisions based on employment not reaching maximum levels.”

After Powell’s speech, the initial market reaction was clearly dovish. The US dollar index dived to an intra-day low, falling by approximately __%. US bonds rebounded across the board, with the two-year Treasury yield falling by a significant amount.

Almost everyone had originally expected Powell not to release any signals that would suggest a rate cut in September. Over the past day or two, including Boston Fed President Collins, officials seemed to reinforce this expectation, but the situation quickly reversed.

Powell stated that the constantly “evolving” economic risks provide the Fed with more justification for cutting interest rates. This statement indicates that Powell aligns with the “dovish” camp within the Federal Open Market Committee responsible for setting interest rates, and also releases a signal that he may support a 25 basis point interest rate cut at the Fed’s next meeting in September. Although Powell acknowledges that the government’s trade war has a “clear impact” on consumer prices, he suggests that this impact is unlikely to be sustained and could be a one-time shock that the central bank can disregard.

He stated, “Given that the labor market is not particularly tight and is facing increasing downside risks, this outcome (of persistently rising inflation) seems unlikely. Inflation faces upward risks, while employment faces downside risks, creating a challenging situation.”

Traders now expect a 90% probability of a Federal Reserve interest rate cut in September, compared to 75% before Powell’s speech. Traders have fully priced in two interest rate cuts by the Fed before the end of the year.

In the stock market, the three major US stock indexes have surged collectively. The Dow has risen over 700 points, the NASDAQ is nearly 2% higher, and the S&P 500 is around 1.5% higher.

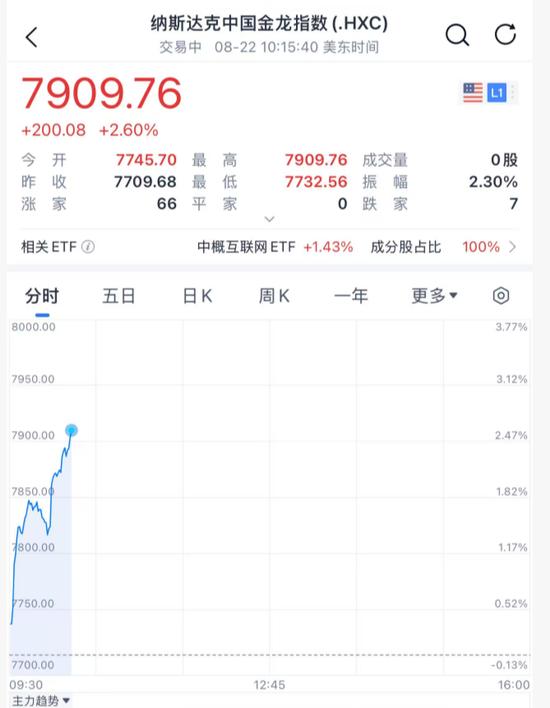

The China concept stock index has risen over 2%!

Following is the full text of Powell’s speech:

Over the past year, the U.S. economy has demonstrated resilience against significant policy changes. In terms of the Fed’s dual mandate objectives, the labor market is still near maximum employment, and while inflation is still somewhat elevated, it has fallen significantly from its post-pandemic peak. At the same time, the balance of risks seems to be shifting.

Today, my speech will be divided into two parts: firstly, discussing the current economic situation and the short-term prospects for monetary policy; secondly, presenting the results of our second public assessment of the monetary policy framework and explaining the revised Statement on Long-Run Goals and Monetary Policy Strategy that we have released today.

At this time last year, I pointed out that the economy was at a turning point. At that time, our policy rate had been maintained at

5.25%-5.5%

for over a year, and this tight stance helped to bring down inflation and facilitate a sustainable balance between supply and demand. Inflation was approaching target, the labor market was cooling from an overheated state, and the upward risk of inflation was diminishing. However, the unemployment rate had risen by almost one percentage point – a historically uncommon occurrence except during recessions. Since then, we have recalibrated our policy stance at three Federal Open Market Committee (FOMC) meetings to create conditions for the labor market to remain balanced near maximum employment over the past year.

This year, the economy faces new challenges:

Trade partners are generally raising tariffs, reshaping the global trade landscape;

移民政策趋紧,劳动人口增速急剧放缓

Tightening immigration policies and a sharp slowdown in the growth of the labor force;

Long-term changes in tax, fiscal expenditure, and regulatory policies may also profoundly affect economic growth and productivity.

There is high uncertainty about the ultimate direction of these policies and their lasting impact on the economy.

The July employment report showed that the average monthly increase in non-farm payrolls over the past three months was much lower than expected for 2024. This slowdown is much more pronounced than previously assessed, mainly due to significant downward revisions in May and June data.

Despite the employment slowdown, there is no obvious idleness in the labor market. The unemployment rate rose slightly in July but remained at a historically low level and has been stable over the past year. Other indicators such as the resignation rate, the layoff rate, the job vacancy and unemployment ratio, and wage growth have also shown only mild weakness.

Overall, the labor market appears to be in balance on the surface, but this is based on a significant slowdown in both supply and demand. This “unusual balance” suggests that the downside risks to employment are rising, and once the risks materialize, they could quickly manifest as a surge in layoffs and an increase in the unemployment rate.

The main reason for this is the deceleration in consumer spending. Tariffs have pushed up the price of some goods. As of July, the Personal Consumption Expenditures (PCE) index rose year-on-year, and the core PCE excluding food and energy also increased. Among them, the core commodity price rose year-on-year (while it had a slight decrease in 2024). Housing service inflation is still on the decline, while non-housing service inflation is slightly higher than the historical level consistent with the 2% target.

The tariff effect has clearly been passed on to consumer prices and will gradually accumulate in the coming months. The baseline scenario is that tariffs lead to a one-time increase in price levels rather than sustained inflation. However, there are risks, including a wage-price spiral (where workers demand higher wages to offset a decline in real income) and a rise in inflation expectations (which could push actual inflation higher).

Currently, with the labor market not under pressure and an increased unemployment risk, the first risk is less likely to occur. As for inflation expectations, despite inflation being above target for over four years, long-term expectations remain anchored at 2%. We will not allow a one-time increase in price levels to evolve into a long-term inflation problem.

In the short term, there is an upward risk to inflation and a downward risk to employment, creating a challenging situation. When the “dual mission” of price stability and employment growth conflicts, we must strike a balance.

The current policy rate is already 100 basis points closer to the neutral level than it was a year ago. The stability of the unemployment rate and other labor market indicators allow us to proceed cautiously, but within the tightening range, changes in the balance of baseline outlook and risks may require adjustments in policy stance.

There is no preset path for monetary policy. Each decision by the Federal Open Market Committee (FOMC) will be based on data and an assessment of economic prospects and risk balances.